Development Impact Fee Advisory Committee Agenda

PDF

Development Impact Fee Advisory Committee

Oct 21, 2025 at 03:35 PM

Processed: Oct 21, 2025 at 07:44 PM

PDF Content

Pages: 105

Development Impact Fee Advisory Committee

Board Meeting

~ Agenda ~

Tuesday, October 21, 2025 3:35 PM City Hall - Room 220

Immediately following the Roswell Development Authority Meeting

Call to Order

1. Approval of the Minutes

Regular Agenda

- 2. Presentation of Draft Impact Fees

- 3. Next Steps (Adoption Timeline/Process)

- 4. Questions and Answers

City of Roswell

Development Impact Fee Advisory Committee

AGENDA ITEM REPORT

ID # - 10137

MEETING DATE: October 21, 2025

DEPARTMENT: Administration

ITEM TYPE: Presentation

Presentation Development Impact Fee Advisory Committee - Second Meeting

Updated: 10/21/2025 1:46 PM Page 1

Roswell, Georgia October 21, 2025

Packet Pg. 3

Development Impact Fee Advisory Mtg #2

Meeting #2: Presentation of Draft Impact Fees Agenda

Welcome and Introductions: Michelle M. Alexander, Director Community Development

Project Objectives and Management: Michelle M. Alexander

Consultant Introduction Carson Bise, AICP

President, Tischler Bise

Draft Impact Fee Results: Carson Bise

Presentation of Draft Impact Fees

Next Steps

Adoption Process/Timeline

Questions/Answers

Development Impact Fee Advisory Committee

- Roswell georgia

- O Development Impact Fee Advisory Committee (Required by State law § 5.)

- Prior to the adoption of a development impact fee ordinance, a municipality or county adopting an impact fee program shall establish a Development Impact Fee Advisory Committee

- o The Development Impact Fee Advisory Committee shall serve in an advisory capacity to assist and advise the governing body of the municipality or county

- Review development projections, assumptions, and methodology

Roswell Impact Fee Study

Roswell's existing Infrastructure categories included:

- Police

- Fire

- Transportation

- Recreation & Parks

Methodologies for Fee Calculations

o Three standard methodologies

- Sometimes multiple methodologies used for one fee category (e.g., plan-based for park land and cost recovery for a recently constructed aquatics center)

- o Cost Recovery (past)

- Oversized and unique facilities

- Funds typically used for debt service

- o Incremental Expansion (present)

- Formula-based approach documents level-of-service with both quantitative and qualitative measures

- o Plan-Based (future)

- Common for utilities but can also be used for other public facilities with non-impact fee funding

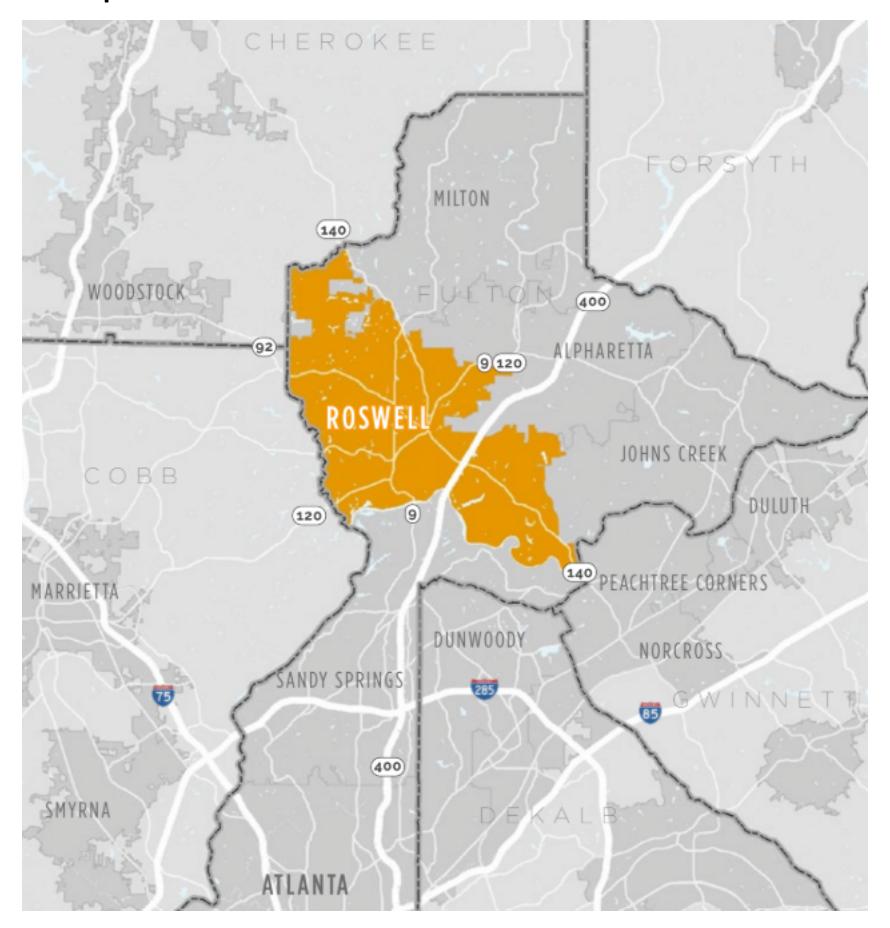

Sources for Development Projections

- 2.1.a

- o Population projection below is based on alternatives in the (current) 2040 Comprehensive Plan

- o Housing units determined using the PPHU factors and housing unit mix from the ACS data

- o Employment data is from the 2050 Metropolitan Transportation Plan (Atlanta MPO)

- o Nonresidential square footage was determined using "employment density factors" established by ITE

2024 2025 2026 2027 2028 2029 2034 Year Year

Roswell,

Georgia Base

Year 1 2 3 4 5 10 Increase Avg.

Inc.

Population 92,236 92,986 93,743 94,505 95,274 96,049 100,019 7,783 778

Housing

Units

Single

Family 26,746 26,985 27,204 27,426 27,649 27,874 29,026 2,280 228

Multi-family 10,872 10,969 11,058 11,148 11,238 11,330 11,798 926 93

Total

Housing

Units 37,618 37,954 38,262 38,573 38,887 39,203 40,824 3,206 321

Employment

Industrial 6,111 6,152 6,194 6,236 6,279 6,321 6,539 428 43

Commercial 10,762 10,835 10,909 10,983 11,057 11,132 11,515 753 75

Office&

Other

Service 17,492 17,611 17,730 17,851 17,972 18,094 18,716 1,224 122

Institutional 13,391 13,482 13,573 13,666 13,758 13,852 14,328 937 94

Total

Employment 47,756 48,080 48,406 48,735 49,066 49,399 51,098 3,342 334

Nonres.

Floor

Area

(x1,000)

Industrial 4,296 4,332 4,368 4,404 4,441 4,477 4,665 370 37

Commercial 6,409 6,443 6,478 6,513 6,548 6,583 6,763 355 35

Office&

Other

Service 7,516 7,552 7,589 7,626 7,663 7,701 7,892 376 38

Institutional 3,986 4,018 4,050 4,082 4,114 4,147 4,314 328 33

Total

Nonres.

Floor

Area

(x1,000) 22,206 22,345 22,484 22,624 22,766 22,908 23,634 1,428 143

2.1.a

Recreation, Parks and Cultural Affairs

- o Incremental expansion methodology

- o Citywide service area

- o Components

- Park Improvements

- Indoor recreation space

- No land component (focus will be on making improvements to undeveloped park land)

- o Credit for principal payments on existing debt

Recreation, Parks and Cultural Affairs

o Park improvements level of service and cost factors

Description Improvements Unit Cost Replacement

Cost

Small Diamond Field 11 \$638,000 \$7,018,000

Large Diamond Field 7 \$838,000 \$5,866,000

Large Rectangular Field 12 \$80,000 \$960,000

Artificial Turf Field 7 \$1,200,000 \$8,400,000

Bocce Court (Outdoor) 3 \$12,000 \$36,000

Pickleball Court

(Outdoor) 4 \$191,000 \$764,000

Futsal Court

(Outdoor) 1 \$191,000 \$191,000

Tennis Court

(Outdoor) 26 \$75,000 \$1,950,000

Volleyball Court

(Outdoor) 2 \$50,000 \$100,000

Playground 9 \$308,000 \$2,772,000

Splashpad 2 \$400,000 \$800,000

Campground 1 \$100,000 \$100,000

Fitness

Area 3 \$2,000 \$6,000

Disc Golf (Holes) 18 \$6,850 \$123,300

Boat

Launch 4 \$80,000 \$320,000

Dog

Park 3 \$15,000 \$45,000

Garden 4 \$60,000 \$240,000

Stage/Ampitheater 3 \$115,000 \$345,000

Picnic Shelter 25 \$20,000 \$500,000

Restroom 28 \$100,000 \$2,800,000

Concessions Building 14 \$38,000 \$532,000

Basketball Gym 7 \$175,000 \$1,225,000

Volleyball Court

(Indoor) 4 \$150,000 \$600,000

Meeting Room 9 \$250,000 \$2,250,000

Pool 1 \$500,000 \$500,000

Total 208 \$184,824 \$38,443,300

2.1.a

Cost

Allocation Factors

Cost

per Improvement \$184,824

Level-of-Service (LOS) Standards

Existing

Improvements 208

Residential

Residential Share 100%

2024 Population 92,236

Improvements per Person 0.0023

Cost per Person \$416.79

Source: City of Roswell

Recreation, Parks and Cultural Affairs

o Indoor recreation and cultural space level of service and cost factors

Description Square Feet Cost/Sq. Ft. Total Cost

Waller Park Community Center 13,288 \$630 \$8,371,440

Adult Aquatics

Facility 13,589 \$378 \$5,136,642

Groveway Adult Recreation Center 20,561 \$588 \$12,089,868

Bill Johnson Community Building 32,301 \$640 \$20,666,180

Roswell River Landing 5,358 \$378 \$2,025,324

Art

Center East 3,094 \$630 \$1,949,220

Cultural Arts Center 35,000 \$840 \$29,400,000

Art

Center West 13,570 \$640 \$8,682,086

Physical Activity Building 38,376 \$589 \$22,618,814

Pool Building 4,278 \$589 \$2,521,453

Visual Arts Center 12,117 \$589 \$7,141,760

Total 191,532 \$630 \$120,602,787

*City's Facilities Condition Assessment adjusted 40% to reflect current construction costs (conversations

with City)

Cost

Allocation Factors

Cost

per Square Foot \$630

Level-of-Service (LOS) Standards

Existing Square Feet 191,532

Residential

Residential Share 100%

2024 Population 92,236

Square Feet per Person 2.0765

Cost per Person \$1,307.55

Source: City of Roswell

2.1.a

Recreation, Parks and Cultural Affairs

o year projection of future park improvement needs

Type of Infrastructure Level of Service Demand Unit Cost

per Unit

Park Improvements 0.0023

Improvements per Person \$184,824

Demand for Park Improvements

Year Population Improvements

2024 92,236 208.0

2025 92,986 209.7

2026 93,743 211.4

2027 94,505 213.1

2028 95,274 214.9

2029 96,049 216.6

2030 96,830 218.4

2031 97,617 220.1

2032 98,411 221.9

2033 99,212 223.7

2034 100,019 225.6

Yr

Increase 7,783 17.6

Growth-Related Expenditures \$3,243,741

2.1.a

Recreation, Parks and Cultural Affairs

o year projection of future indoor recreation and cultural needs

Type of Infrastructure Level of Service Demand Unit Cost

per Sq. Ft.

Community

Centers 2.0765

Square Feet per Person \$630

Demand for Community

Centers

Year Population Square Feet

2024 92,236 191,532

2025 92,986 193,090

2026 93,743 194,660

2027 94,505 196,244

2028 95,274 197,840

2029 96,049 199,449

2030 96,830 201,071

2031 97,617 202,706

2032 98,411 204,355

2033 99,212 206,017

2034 100,019 207,693

Yr Increase 7,783 16,161

Growth-Related Expenditures \$10,176,134

Recreation, Parks and Cultural Affairs

o Credit for future principal payments on existing debt

Year Principal

Payment 2023

GO Debt Population Debt Cost

per Capita

2026 \$674,520 92,986 \$7.25

2027 \$708,400 93,743 \$7.56

2028 \$742,280 94,505 \$7.85

2029 \$779,240 95,274 \$8.18

2030 \$819,280 96,049 \$8.53

2031 \$859,320 96,830 \$8.87

2032 \$902,440 97,617 \$9.24

2033 \$948,640 98,411 \$9.64

2034 \$994,840 99,212 \$10.03

2035 \$1,044,120 100,019 \$10.44

2036 \$1,099,560 100,832 \$10.90

2037 \$1,151,920 101,652 \$11.33

2038 \$1,207,360 102,479 \$11.78

2039 \$1,268,960 103,313 \$12.28

2040 \$1,333,640 104,153 \$12.80

2041 \$1,386,000 105,000 \$13.20

2042 \$1,444,520 105,778 \$13.66

2043 \$1,499,960 106,556 \$14.08

2044 \$1,561,560 107,334 \$14.55

2045 \$1,620,080 108,112 \$14.99

Total \$22,046,640 \$217.17

Discount

Rate 5.0%

Net Present Value \$127.11

Recreation, Parks and Cultural Affairs

o Draft maximum allowable impact fee

Fee Component Cost per Person

Park Improvements \$416.79

Community

Centers \$1,307.55

Principal Payment

Credit (\$127.11)

Net

Cost per Demand Unit \$1,597.23

Residential

Development Fees per Unit

Persons per Maximum Current Increase or Percent

Development Type Unit1

Housing Allowable Fees Fees2 (Decrease) Change

Single Family 2.66 \$4,249 \$663 \$3,586 541%

Multi-Family 1.94 \$3,099 \$451 \$2,648 587%

1. See Land Use Assumptions

2. From current fee schedule; assuming Single Family homes are >2,500 sq. ft. and Multi-Family homes are •2,500 sq. ft.

o Incremental expansion methodology

- o Citywide service area

- o Components

- Station space

- Vehicles/apparatus

- o Credit for principal payments on existing debt

Fire

o Station space level of service and cost factors

Cost

Allocation Factors

Cost

per Square Foot \$603

Description Square Feet Cost/Sq. Ft. Total Cost

Station 21 16,368 \$661 \$10,815,974

Station 22 2,900 \$1,120 \$3,248,000

Station 23 3,000 \$1,120 \$3,360,000

Station 24 14,090 \$630 \$8,876,700

Station 25 7,258 \$498 \$3,617,387

Station 26 8,217 \$560 \$4,601,520

Station 27 9,947 \$630 \$6,266,610

Fire RAPSTC 10,314 \$497 \$5,126,058

Fire Training

Burn Building 3,504 \$498 \$1,746,394

Summit

Building

(Fire Share) 9,082 \$378 \$3,432,996

Total 84,680 \$603 \$51,091,639

*City's Facilities Condition Assessment adjusted 40% to

reflect current construction costs (conversations with City)

Level-of-Service (LOS) Standards

Existing Square Feet 84,680

Residential

Residential Share 69%

2024 Population 92,236

Square Feet per Person 0.6335

Cost per Person \$382.21

Nonresidential

Nonresidential Share 31%

2024 Vehicle Trips 147,710

Square Feet per Vehicle Trip 0.1777

Cost per Vehicle Trip \$107.23

Source: Roswell Fire Department

Fire

o Vehicle/apparatus level of service and cost factors

Description Count Cost

Per Unit Total

Cost

Engine 9 \$1,080,676 \$9,726,084

Aerial 4 \$2,249,520 \$8,998,080

Heavy Rescue 1 \$2,704,000 \$2,704,000

Pick Up 16 \$165,000 \$2,640,000

SUV 11 \$96,538 \$1,061,918

Med Unit 3 \$400,000 \$1,200,000

Brush/Truck 1 \$230,000 \$230,000

CRR 1 \$250,000 \$250,000

Rescue

Boat 1 \$125,000 \$125,000

TOTAL 47 \$573,087 \$26,935,082

Cost

Allocation Factors

Total

Vehicles 47

Total

Cost \$26,935,082

Cost per Vehicle \$573,087

Level-of-Service (LOS) Standards

Existing Vehicles 47

Residential

Residential Share 69%

2024 Population 92,236

Vehicles

per Person 0.0004

Cost per Person \$201.50

Nonresidential

Nonresidential Share 31%

2024 Vehicle Trips 147,710

Vehicles

per Vehicle Trip 0.0001

Source: Roswell Fire Department

georgia

Fire

o year projection of future station space needs

Type of Infrastructure Level of Service Demand Unit Cost per Sq Ft

Fire Facilities 0.6335 Square Feet per Person \$603

rii e raciiities 0.1777 Square Feet per Vehicle Trip Ф 003

Demand for Fire Facilities

Year Population Nonresidential Fire e Station Square F eet

Teal ropulation Vehicle Trips Residential Nonresidential Total

2024 92,236 147,710 58,429 26,251 84,680

2025 92,986 148,559 58,904 26,402 85,306

2026 93,743 149,414 59,384 26,554 85,937

2027 94,505 150,275 59,867 26,707 86,573

2028 95,274 151,142 60,353 26,861 87,214

2029 96,049 152,014 60,844 27,016 87,860

2030 96,830 152,893 61,339 27,172 88,511

2031 97,617 153,777 61,838 27,329 89,167

2032 98,411 154,668 62,341 27,487 89,828

2033 99,212 155,564 62,848 27,647 90,495

2034 100,019 156,467 63,359 27,807 91,166

Yr Increase 7,783 8,757 4,930 1,556 6,486

georgia

Fire

o year projection of future vehicle/apparatus needs

Type of Infrastructure Level of Service Demand Unit Cost per Unit

Fire Apparatus 0.0004 Vehicles per Person \$573,087

Fire Apparatus 0.0001 Vehicles per Vehicle Trip \$373,007

Demand for Fire Apparatus

Year Population Nonresidential Vehicles

rear ropulation Vehicle Trips Residential Nonresidential Total

2024 92,236 147,710 32.4 14.6 47.0

2025 92,986 148,559 32.7 14.7 47.3

2026 93,743 149,414 33.0 14.7 47.7

2027 94,505 150,275 33.2 14.8 48.1

2028 95,274 151,142 33.5 14.9 48.4

2029 96,049 152,014 33.8 15.0 48.8

2030 96,830 152,893 34.0 15.1 49.1

2031 97,617 153,777 34.3 15.2 49.5

2032 98,411 154,668 34.6 15.3 49.9

2033 99,212 155,564 34.9 15.3 50.2

2034 100,019 156,467 35.2 15.4 50.6

Yr Increase 7,783 8,757 2.7 0.9 3.6

Growth-Related Expenditures \$1,568,169 \$495,036 \$2,063,205

3. 3 +:/000/:0/ + . , 5 5 5 + - 0 0 0 - 0 0

o Credit for future principal payments on existing debt

Year Principal

Payment 2016

Fire Truck Debt Principal

Payment 2023

GO Debt Principal

Payment 2019

Fire Truck Debt Principal

Payment 2022

Fire Truck Debt Res. Share

69% Population Debt Cost

per Capita Nonres. Share

31% Nonres.

Vehicle Trips Debt Cost

per Trip

2026 \$54,484 \$83,111 \$122,212 \$82,780 \$236,385 92,986 \$2.54 \$106,202 148,559 \$0.71

2027 \$87,285 \$125,194 \$85,429 \$205,557 93,743 \$2.19 \$92,352 149,414 \$0.62

2028 \$91,460 \$128,249 \$88,163 \$212,431 94,505 \$2.25 \$95,440 150,275 \$0.64

2029 \$96,014 \$131,378 \$90,984 \$219,679 95,274 \$2.31 \$98,697 151,142 \$0.65

2030 \$100,947 \$93,896 \$134,441 96,049 \$1.40 \$60,401 152,014 \$0.40

2031 \$105,881 \$96,900 \$139,919 96,830 \$1.44 \$62,862 152,893 \$0.41

2032 \$111,194 \$100,001 \$145,724 97,617 \$1.49 \$65,470 153,777 \$0.43

2033 \$116,886 \$103,201 \$151,860 98,411 \$1.54 \$68,227 154,668 \$0.44

2034 \$122,579 \$106,504 \$158,067 99,212 \$1.59 \$71,015 155,564 \$0.46

2035 \$128,651 \$109,912 \$164,608 100,019 \$1.65 \$73,954 156,467 \$0.47

2036 \$135,482 \$113,429 \$171,748 100,832 \$1.70 \$77,162 157,376 \$0.49

2037 \$141,933 \$117,059 \$178,704 101,652 \$1.76 \$80,287 158,291 \$0.51

2038 \$148,764 \$102,647 102,479 \$1.00 \$46,117 159,212 \$0.29

2039 \$156,354 \$107,884 103,313 \$1.04 \$48,470 160,139 \$0.30

2040 \$164,324 \$113,383 104,153 \$1.09 \$50,940 161,073 \$0.32

2041 \$170,775 \$117,835 105,000 \$1.12 \$52,940 162,013 \$0.33

2042 \$177,986 \$122,810 105,778 \$1.16 \$55,176 162,959 \$0.34

2043 \$184,817 \$127,523 106,556 \$1.20 \$57,293 163,912 \$0.35

2044 \$192,407 \$132,760 107,334 \$1.24 \$59,646 164,871 \$0.36

2045 \$199,617 \$137,736 108,112 \$1.27 \$61,881 165,837 \$0.37

Total \$54,484 \$2,716,461 \$507,035 \$1,188,257 \$3,081,703 \$30.99 \$1,384,533 \$8.89

Discount Rate 5.0% 5.0%

Net

Present Value \$20.61 \$5.89

Fire

o Draft maximum allowable impact fee

Fee Component Cost per Person Cost per Trip

Fire Facilities \$382.21 \$107.23

Fire Apparatus \$201.50 \$56.53

Principal Payment

Credit (\$20.61) (\$5.89)

Net

Cost Per Demand Unit \$563.09 \$157.86

Residential Development Fees per Unit

Persons per Maximum Increase

or Percent

Development

Type Unit1

Housing Allowable Fees Fees2

Current (Decrease) Change

Single Family 2.66 \$1,498 \$1,086 \$412 38%

Multi-Family 1.94 \$1,092 \$738 \$354 48%

Nonresidential

Development Fees per 1,000 Square Feet

Development

Type Average Wkdy

Vehicle Trips1 Maximum

Allowable Fees Fees3

Current Increase

or

(Decrease) Percent

Change

Industrial 1.69 \$266 \$180 \$86 48%

Commercial 12.21 \$1,928 \$260 \$1,668 642%

Office & Other Services 5.42 \$856 \$320 \$536 167%

Institutional 5.39 \$850 \$320 \$530 166%

- 1. See Land Use Assumptions

- 2. From current fee schedule; assuming Single Family homes are >2,500 sq. ft. and Multi-Family homes are •2,500 sq. ft.

- 3. From current fee schedule; assuming Institutional development currently falls under the Office & Other Services

o Incremental expansion methodology

- o Citywide service area

- o Components

- Station/911 Center space

- o Credit for principal payments on existing debt

Police

o Station space level of service and cost factor s

Descriptio

n Square Feet Cost/Sq. Ft.

Total Cost

Police Shared Evidence 10,500 \$490 \$5,145,000

Police Storage Building 4,056 \$420 \$1,703,520

911 Dispatch

Center 7,500 \$636 \$4,767,000

Summit Building (Police Share) 53,918 \$630 \$33,968,340

Total 75,974 \$600 \$45,583,860

*City's Facilities Condition Assessment adjusted 40% to reflect current construction costs (conversations with City)

Cost

Allocation Factors

Cost

per Square Foot \$600

Level-of-Service (LOS) Standards

Existing

Square Feet 75,974

Residential

Residential Share 69%

2024 Population 92,236

Police Square Feet

per Person 0.5683

Cost per Person \$341.00

Nonresidential

Nonresidential Share 31%

2024 Vehicle Trip

s 147,710

Square Feet

per Vehicle Trip 0.1594

Source: Roswell Police Departmen t

Police

o year projection of future station space needs

Type of Infrastructure Level of Service Demand Unit Cost per Sq Ft

Police Facilities 0.5683 Square Feet per Person \$600

Folice Facilities 0.1594 Square Feet per Vehicle Trip \$000

Demand for Police Facilities

Year Donulation Nonresidential Polid ce Station Square Feet

reai Population Vehicle Trips Residential Nonresidential Total

2024 92,236 147,710 52,422 23,552 75,974

2025 92,986 148,559 52,848 23,687 76,536

2026 93,743 149,414 53,278 23,824 77,102

2027 94,505 150,275 53,712 23,961 77,673

2028 95,274 151,142 54,148 24,099 78,248

2029 96,049 152,014 54,589 24,238 78,827

2030 96,830 152,893 55,033 24,378 79,411

2031 97,617 153,777 55,481 24,519 80,000

2032 98,411 154,668 55,932 24,661 80,593

2033 99,212 155,564 56,387 24,804 81,191

2034 100,019 156,467 56,845 24,948 81,794

Yr Increase 7,783 8,757 4,423 1,396 5,820

Growth-Related Expenditures \$2,653,907 \$837,779 \$3,491,686

Police

O Credit for future principal payments on existing debt

Year Principal Payment

2024 Police Tahoe

Debt Principal Payment

2023 GO Debt Res. Share 69% Population Debt Cost

per Capita Nonres. Share

31% Nonres. Vehicle

Trips Debt Cost

per Trip

2026 \$255,365 \$83,111 \$233,548 92,986 \$2.51 \$104,927 148,559 \$0.71

2027 \$268,593 \$87,285 \$245,556 93,743 \$2.62 \$110,322 149,414 \$0.74

2028 \$282,506 \$91,460 \$258,036 94,505 \$2.73 \$115,929 150,275 \$0.77

2029 \$297,140 \$96,014 \$271,276 95,274 \$2.85 \$121,878 151,142 \$0.81

2030 \$100,947 \$69,653 96,049 \$0.73 \$31,294 152,014 \$0.21

2031 \$105,881 \$73,058 96,830 \$0.75 \$32,823 152,893 \$0.21

2032 \$111,194 \$76,724 97,617 \$0.79 \$34,470 153,777 \$0.22

2033 \$116,886 \$80,651 98,411 \$0.82 \$36,235 154,668 \$0.23

2034 \$122,579 \$84,579 99,212 \$0.85 \$37,999 155,564 \$0.24

2035 \$128,651 \$88,769 100,019 \$0.89 \$39,882 156,467 \$0.25

2036 \$135,482 \$93,482 100,832 \$0.93 \$41,999 157,376 \$0.27

2037 \$141,933 \$97,934 101,652 \$0.96 \$43,999 158,291 \$0.28

2038 \$148,764 \$102,647 102,479 \$1.00 \$46,117 159,212 \$0.29

2039 \$156,354 \$107,884 103,313 \$1.04 \$48,470 160,139 \$0.30

2040 \$164,324 \$113,383 104,153 \$1.09 \$50,940 161,073 \$0.32

2041 \$170,775 \$117,835 105,000 \$1.12 \$52,940 162,013 \$0.33

2042 \$177,986 \$122,810 105,778 \$1.16 \$55,176 162,959 \$0.34

2043 \$184,817 \$127,523 106,556 \$1.20 \$57,293 163,912 \$0.35

2044 \$192,407 \$132,760 107,334 \$1.24 \$59,646 164,871 \$0.36

2045 \$199,617 \$137,736 108,112 \$1.27 \$61,881 165,837 \$0.37

Total \$1,103,604 \$2,716,461 \$2,635,845 \$26.55 \$1,184,220 \$7.60

Discount Rate 5.0% 5.0%

Net Present Value \$17.96 \$5.12

Police

o Draft maximum allowable impact fee

Fee Component Cost per Person Cost per Trip

Police Facilities \$341.00 \$95.67

Principal

Payment

Credit (\$17.96) (\$5.12)

Net

Cost per Demand Unit \$323.05 \$90.55

Residential Development Fees per Unit

Persons per Maximum Current Increase or

Development Type Unit1

Housing Allowable Fees Fees2 (Decrease)

Single

Family 2.66 \$859 \$0 \$859

Multi-Family 1.94 \$627 \$0 \$627

Nonresidential

Development Fees per 1,000 Square Feet

Average Wkdy Maximum Current Increase or

Development Type Trips1

Vehicle Allowable Fees Fees2 (Decrease)

Industrial 1.69 \$153 \$0 \$153

Commercial 12.21 \$1,106 \$0 \$1,106

Office

& Other Service 5.42 \$491 \$0 \$491

Institutional 5.39 \$488 \$0 \$488

- 1. See Land Use Assumptions

- 2. Currently no impact fee assessed for Police.

- o Plan-based methodology

- o Citywide service area

- o Components

- Roadway projects

- Pedestrian projects

- o Credit for future TSPLOST project funding

Travel Demand Model

o Projection of person trips

Development Dev ITE Avg Wkday Trip 2024 2024

Type Unit Code PTE Adjustment Dev Units Pers Trips

Single Family HU 210 16.49 66% 26,746 291,174

Multi-Family HU 220 11.79 66% 10,872 84,596

Industrial KSF 130 6.58 50% 4,296 14,133

Commercial KSF 820 72.26 33% 6,409 152,829

Office & Other Services KSF 710 21.17 50% 7,516 79,536

Institutional KSF 610 21.03 50% 3,986 41,909

Total 664,178

Roswell, GA Base 1 2 3 4 5 6 7 8 9 10 Year

Roswell, GA 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Increase

Single Family Units 26,746 26,932 27,151 27,371 27,594 27,819 28,045 28,273 28,503 28,735 28,968 2,222

ent Multi-Family Units 10,872 11,004 11,094 11,184 11,275 11,367 11,459 11,552 11,646 11,741 11,837 965

E d Industrial KSF 4,296 4,332 4,368 4,404 4,441 4,477 4,515 4,552 4,589 4,627 4,665 370

velo Commercial KSF 6,409 6,443 6,478 6,513 6,548 6,583 6,619 6,654 6,690 6,727 6,763 355

2 Office & Other Services KSF 7,516 7,552 7,589 7,626 7,663 7,701 7,738 7,776 7,814 7,853 7,892 376

Institutional KSF 3,986 4,018 4,050 4,082 4,114 4,147 4,180 4,213 4,247 4,280 4,314 328

Single-Family Trips 291,174 293,194 295,579 297,983 300,407 302,850 305,313 307,797 310,300 312,824 315,368 24,194

Multi-Family Trips 84,596 85,626 86,322 87,024 87,732 88,445 89,165 89,890 90,621 91,358 92,101 7,505

6 Residential Trips 375,771 378,820 381,901 385,007 388,139 391,296 394,478 397,687 400,921 404,182 407,470 31,699

Pers Industrial Trips 14,133 14,251 14,370 14,489 14,610 14,731 14,853 14,976 15,099 15,224 15,349 1,216

lay Commercial Trips 152,829 153,649 154,474 155,306 156,142 156,985 157,833 158,687 159,546 160,412 161,283 8,454

eko Office & Other Services Trips 79,536 79,922 80,311 80,702 81,096 81,493 81,892 82,294 82,698 83,106 83,516 3,980

× Institutional Trips 41,909 42,243 42,580 42,919 43,260 43,604 43,950 44,299 44,649 45,002 45,358 3,449

Avg Nonresidential Trips 288,407 290,066 291,735 293,416 295,108 296,812 298,527 300,254 301,993 303,744 305,506 17,099

Total Person Trips 664,178 668,886 673,636 678,423 683,247 688,108 693,006 697,941 702,915 707,926 712,976 48,798

Travel Demand Model

o Projection of average weekday vehicle trips

Development Dev ITE Avg Wkday Trip 2024 2024

Type Unit Code VTE Adjustment Dev Units Veh Trips

Single Family HU 210 9.43 66% 26,746 166,462

Multi-Family HU 220 6.74 66% 10,872 48,363

Industrial KSF 130 3.37 50% 4,296 7,238

Commercial KSF 820 37.01 33% 6,409 78,272

Office & Other Services KSF 710 10.84 50% 7,516 40,735

Institutional KSF 610 10.77 50% 3,986 21,464

Total 362,535

Roswell, GA Base 1 2 3 4 5 6 7 8 9 10 Year

Noswell, GA 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Increase

Single Family Units 26,746 26,932 27,151 27,371 27,594 27,819 28,045 28,273 28,503 28,735 28,968 2,222

ent Multi-Family Units 10,872 11,004 11,094 11,184 11,275 11,367 11,459 11,552 11,646 11,741 11,837 965

E. Industrial KSF 4,296 4,332 4,368 4,404 4,441 4,477 4,515 4,552 4,589 4,627 4,665 370

velo Commercial KSF 6,409 6,443 6,478 6,513 6,548 6,583 6,619 6,654 6,690 6,727 6,763 355

De Office & Other Services KSF 7,516 7,552 7,589 7,626 7,663 7,701 7,738 7,776 7,814 7,853 7,892 376

Institutional KSF 3,986 4,018 4,050 4,082 4,114 4,147 4,180 4,213 4,247 4,280 4,314 328

Single-Family Trips 166,462 167,617 168,980 170,354 171,740 173,137 174,545 175,965 177,396 178,839 180,293 13,832

를 Multi-Family Trips 48,363 48,951 49,350 49,751 50,156 50,563 50,975 51,389 51,807 52,229 52,654 4,291

Se Residential Trips 214,825 216,568 218,330 220,105 221,896 223,700 225,520 227,354 229,203 231,067 232,947 18,122

/ehi Industrial Trips 7,238 7,299 7,360 7,421 7,482 7,544 7,607 7,670 7,733 7,797 7,861 623

a s Commercial Trips 78,272 78,692 79,115 79,541 79,969 80,401 80,835 81,272 81,713 82,156 82,602 4,330

ekd Office & Other Services Trips 40,735 40,933 41,132 41,332 41,534 41,737 41,941 42,147 42,355 42,563 42,773 2,038

×e × Institutional Trips 21,464 21,635 21,808 21,981 22,156 22,332 22,509 22,688 22,867 23,048 23,230 1,767

N N Nonresidential Trips 147,710 148,559 149,414 150,275 151,142 152,014 152,893 153,777 154,668 155,564 156,467 8,757

Total Vehicle Trips 362,535 365,127 367,744 370,380 373,037 375,715 378,413 381,131 383,871 386,632 389,414 26,879

Transportation

o Proposed roadway and pedestrian capacity expanding projects

Category Roadway Projects Cost Category Pedestrian Projects Cost

Intersection Alpharetta

Hwy (@ Hembree Rd) \$900,000 Corridor Canton Street \$2,500,000

Intersection Alpharetta

Hwy (@ Hill St) \$45,000 Corridor Cherry Way \$1,061,333

Intersection Alpharetta

Hwy (@ Mansell Rd) \$45,000 Corridor Green Street \$1,988,898

Intersection Alpharetta

Hwy (@ Norcross St) \$20,000 Corridor Warsaw Road Safety Improvements \$1,662,363

Intersection Alpharetta

Hwy (@ Upper Hembree Rd) \$20,000 Corridor Webb Street \$4,561,000

Intersection Canton Street (@ Webb St) \$900,000 Bicycle/Pedestrian Canton Street \$126,298

Intersection Crabapple Road (@ Hembree Rd) \$4,075,000 Bicycle/Pedestrian Crabapple Rd \$2,131,634

Intersection Crossville Road (@ Crabapple Rd) \$35,000 Bicycle/Pedestrian Crabapple Rd/Canton St \$1,720,120

Intersection Grimes Bridge Road (@ Dogwood Rd) \$1,465,214 Bicycle/Pedestrian East Roswell Trail \$3,708,204

Intersection Hardscrabble Road (@ Etris Rd) \$20,000 Bicycle/Pedestrian Elkins Rd \$2,737,144

Intersection Hardscrabble Road (@ King

Rd) \$4,075,000 Bicycle/Pedestrian Grimes Bridge Rd \$2,142,451

Intersection Holcomb Bridge Road (@ Alpharetta Hwy) \$35,000 Bicycle/Pedestrian Grimes Bridge Rd \$2,350,536

Intersection Holcomb Bridge Road (@ Dogwood Rd) \$19,673,722 Bicycle/Pedestrian Grimes Bridge Rd \$1,521,133

Intersection Holcomb Bridge Road (@ Old Alabama Rd) \$150,000 Bicycle/Pedestrian Hembree Rd \$4,972,250

Intersection Holcomb Bridge Road (@ Warsaw Rd) \$8,991,743 Bicycle/Pedestrian Hog

Wallow Creek \$2,177,952

Intersection Houze Rd (@ Crabapple Rd) \$50,000 Bicycle/Pedestrian Hog

Wallow Creek \$2,726,245

Intersection Houze Rd (@ Mansell Rd) \$2,000,000 Bicycle/Pedestrian Hog

Wallow Creek \$4,115,609

Intersection Mansell Road (@ Colonial Center Pwky) \$20,000 Bicycle/Pedestrian Holcomb Bridge Rd \$100,000

Intersection Mansell Road (@ Warsaw Rd) \$50,000 Bicycle/Pedestrian Holcomb Bridge Rd \$4,139,969

Intersection Marietta Hwy (@ Willeo Rd) \$20,000 Bicycle/Pedestrian Holcomb Bridge Rd \$4,269,630

Intersection Old Alabama Road (@ Roxburgh Dr) \$8,500,000 Bicycle/Pedestrian Holcomb Woods Pkwy \$50,000

Intersection Old Roswell Road (@ Old Roswell Pl) \$350,000 Bicycle/Pedestrian Jones Rd \$415,000

Intersection Riverside Rd (@ Dogwood Rd) \$4,075,000

Intersection SR 9/120 (Village Center) \$12,968,467 Bicycle/Pedestrian Market Boulevard \$2,713,378

Intersection Woodstock Rd (@ Mtn. Park) \$30,000 Bicycle/Pedestrian Mimosa Blvd/Oxbo Rd \$2,597,286

Realignments Big Creek Pkwy (Phase III) \$63,956,100 Bicycle/Pedestrian Norcross St \$1,707,544

Realignments Commerce Parkway \$2,081,490 Bicycle/Pedestrian Norcross St \$2,236,178

Realignments Houze Road \$4,827,256 Bicycle/Pedestrian N-S Corridor \$2,581,679

Realignments Mansell Road \$13,685,230 Bicycle/Pedestrian Old Roswell Cemetary Trail \$417,574

Realignments Old Ellis/Sun Valley Connector \$2,119,491 Bicycle/Pedestrian Old Roswell Rd \$1,849,055

Realignments Riverwalk Emergency Access \$154,355 Bicycle/Pedestrian Warsaw Rd \$2,567,271

Realignments Sun Valley/Houze Connector \$550,518 Bicycle/Pedestrian Willeo Rd \$1,956,233

Total \$155,888,586 Total \$69,803,967

Source: City of Roswell Transportation Master Plan, 2023.

2.1.a

Source: City of Roswell Transportation Master Plan, 2023.

o Level of service and cost factor s

Cost

Factors

Roadway

Projects

Cost \$155,888,586

Pedestrian Projects

Cost \$69,803,967

Level-of-Service (LOS) Standards

2034 Vehicle Trips 389,414

Cost

per Vehicle Trip \$400.32

2034 Person Trips 712,976

Cost

per Person Tri

p \$97.91

Transportation

Credit for future TSPLOST funding to transportation projects

TSPLOST III Credit

Fiscal

Year Annual Debt

Service Roadway

Share Vehicle Trips Payment

per Veh Trip Pedestrian

Share Person Trips

Trips Payment

per Per Trip

2024 \$0 \$0 362,535 \$0.00 \$0 664,178 \$0.00

2025 \$13,333,333 \$9,209,495 365,127 \$25.22 \$4,123,838 668,886 \$6.17

2026 \$13,333,333 \$9,209,495 367,744 \$25.04 \$4,123,838 673,636 \$6.12

2027 \$13,333,333 \$9,209,495 370,380 \$24.86 \$4,123,838 678,423 \$6.08

2028 \$13,333,333 \$9,209,495 373,037 \$24.69 \$4,123,838 683,247 \$6.04

2029 \$13,333,333 \$9,209,495 375,715 \$24.51 \$4,123,838 688,108 \$5.99

2030 \$13,333,333 \$9,209,495 378,413 \$24.34 \$4,123,838 693,006 \$5.95

2031 \$0 \$0 381,131 \$0.00 \$0 697,941 \$0.00

2032 \$0 \$0 383,871 \$0.00 \$0 702,915 \$0.00

2033 \$0 \$0 386,632 \$0.00 \$0 707,926 \$0.00

2034 \$0 \$0 389,414 \$0.00 \$0 712,976 \$0.00

Total \$80,000,000 \$55,256,971 \$148.67 \$24,743,029 \$36.34

Rate 3.00% Credit per Vehicle Trip \$130.40 Credit per Person Trip \$31.88

Transportation

Draft maximum allowable impact fee

Fee Component Cost per Vehicle

Trip Cost per Person

Trip

Roadway \$400.32 \$0.00

Pedestrian \$0.00 \$97.91

TSPLOST III Credit (\$130.40) (\$31.88)

Total \$269.92 \$66.03

Residential Fees per Unit

Unit Type Average Weekday Vehicle Trips 1 Average Weekday

Person Trips 1 Roadway Pedestrian Maximum

Allowable Fees Current

Fees 2 Increase / (Decrease) Percent

Change

Single Family

Multi-Family 4.45 7.78 \$1,201 \$514 \$1,714 \$1,363 \$351 26%

Nonresidential Fees per 1,000 Square Feet

Development Type Average Weekday Average Weekday Roadway Pedestrian Maximum Current Increase / Percent

Development Type Vehicle Trips 1 Person Trips 1 Roadway redestriari Allowable Fees Fees 3 (Decrease) Change

Industrial 1.69 3.29 \$455 \$217 \$672 \$865 (\$193) -22%

Commercial 12.21 23.85 \$3,297 \$1,574 \$4,871 \$2,718 \$2,153 79%

Office & Other Services 5.42 10.58 \$1,463 \$699 \$2,162 \$1,176 \$986 84%

Institutional 5.39 10.51 \$1,453 \$694 \$2,148 \$1,176 \$972 83%

- 1. See Land Use Assumptions

- 2. From current fee schudule; assuming Single Family homes are >2,500 sq. ft. and Multi-Family homes are •2,500 sq. ft.

- 3. From current fee schedule; assuming Institutional development currently falls under the Office & Other Services category.

Impact Fee Summary

2.1.a Attachment: 21 Roswell Stakeholder Meeting - UPDATED Compressed (Presentation DIFA georgia

Draft maximum allowable impact fees

Maximum Allowable Impact Fees

Residential Development Fees Per Unit

Development Type Parks & Recreation Police Fire Transportation Total

Single Family \$4,249 \$859 \$1,498 \$2,399 \$270 \$9,275

Multi-Family \$3,099 \$627 \$1,092 \$1,714 \$196 \$6,728

Nonresidential Development Fees per 1, 000 Square Feet

Development Type Parks &

Recreation Police Fire Transportation Admin

(3%) Total

Industrial \$0 \$153 \$266 \$672 \$33 \$1,123

Commercial \$0 \$1,106 \$1,928 \$4,871 \$237 \$8,142

Office & Other Services \$0 \$491 \$856 \$2,162 \$105 \$3,613

Institutional \$0 \$488 \$850 \$2,148 \$105 \$3,590

Current Fees

Residential Development Fees Per Unit

Development Type Parks & Recreation Police Fire Transportation Admin

(3%) Total

Single Family 1 \$663 \$0 \$1,086 \$2,004 \$59 \$3,812

Multi-Family 1 \$451 \$0 \$738 \$1,363 \$87 \$2,639

Residential Development Fees Per Unit

Development Type Parks & Recreation Police Fire Transportation Admin

(3%) Total

Single Family \$3,586 \$859 \$412 \$395 \$211 \$5,463

Multi-Family \$2,648 \$627 \$354 \$351 \$109 \$4,089

Nonresidential Development t Fees per 1,000 Square Feet

Parks & Admin

Increase / (Decrease)

Nonresidential Development Fees per 1, 000 Square Feet

Development Type Parks & Recreation Police Fire Transportation Admin

(3%) Total

Industrial \$0 \$0 \$180 \$865 \$20 \$1,065

Commercial \$0 \$0 \$260 \$2,718 \$55 \$3,033

Office & Other Services \$0 \$0 \$320 \$1,176 \$30 \$1,526

Institutional 2 \$0 \$0 \$320 \$1,176 \$30 \$1,526

Nonresidential Development Fees per 1, 000 Square Feet

Development Type Parks & Recreation Police Fire Transportation Admin

(3%) Total

Industrial \$0 \$153 \$86 (\$193) \$13 \$58

Commercial \$0 \$1,106 \$1,668 \$2,153 \$182 \$5,109

Office & Other Services \$0 \$491 \$536 \$986 \$75 \$2,087

Institutional \$0 \$488 \$530 \$972 \$75 \$2,064

1. From current fee schudule; assuming Single Family homes are >2,500 sq. ft. and Multi-Family homes are •2,500 sq. ft.

2. From current fee schedule; assuming Institutional development currently falls under the Office & Other Services category.

Impact Fee Comparison

O Comparison of single family fees to nearby communities

Community Recreation &

Parks Library Police Fire Transportation Admin (3%) Total Single Family

Impact Fee

Milton \$6,915 \$0 \$203 \$1,763 \$1,461 \$310 \$10,652

Roswell \$4,249 \$0 \$859 \$1,498 \$2,399 \$270 \$9,275

Forsyth County 1 \$1,253 \$157 \$543 \$0 \$7,066 \$0 \$9,019

Sandy Springs 1 \$4,544 \$0 \$445 \$0 \$1,667 \$200 \$6,856

Alpharetta 2 - - - - - \$195 \$6,690

Cumming \$2,157 \$148 \$328 \$510 \$2,104 \$0 \$5,247

Canton \$2,809 \$0 \$77 \$539 \$406 \$115 \$3,946

Gainesville \$1,400 \$261 \$375 \$685 \$0 \$82 \$2,803

Cherokee County 1 \$1,620 \$126 \$60 \$581 \$174 \$0 \$2,561

Stockbridge \$1,246 \$0 \$0 \$0 \$1,105 \$71 \$2,422

Kennesaw \$628 \$0 \$50 \$0 \$0 \$21 \$699

[1] Public Safety fee shown as Police here

[2] Fee schedule by facility type not published

o Present findings and recommended options to Mayor and Council

- o Begin adoption process

Questions?

Impact Fee Report and Capital Improvement Element (An Amendment to the Comprehensive Plan)

Prepared for: City of Roswell, Georgia

October 2, 2025

4701 SANGAMORE ROAD SUITE S240 BETHESDA, MD 20816 301.320.6900

WWW.TISCHLERBISE.COM

[PAGE INTENTIONALLY LEFT BLANK]

TABLE OF CONTENTS

Executive Summary 1

IMPACT FEE COMPONENTS 5

MAXIMUM ALLOWABLE IMPACT FEES 6

CAPITAL IMPROVEMENT ELEMENT 8

RECREATION & PARKS 9

Police 10

FIRE 10

Transportation 11

FUNDING SOURCES FOR CAPITAL IMPROVEMENTS 13

RECREATION & PARKS IMPACT FEE 14

METHODOLOGY 14

PROPORTIONATE SHARE 14

SERVICE UNITS 14

PARK IMPROVEMENTS - INCREMENTAL EXPANSION 15

COMMUNITY CENTERS - INCREMENTAL EXPANSION 16

PROJECTED DEMAND FOR GROWTH-RELATED PARKS INFRASTRUCTURE 16

Park Improvements 16

Community Centers

CREDITS

MAXIMUM ALLOWABLE RECREATION & PARKS IMPACT FEES

PROJECTED RECREATION & PARKS IMPACT FEE REVENUE

Police Impact Fee

METHODOLOGY

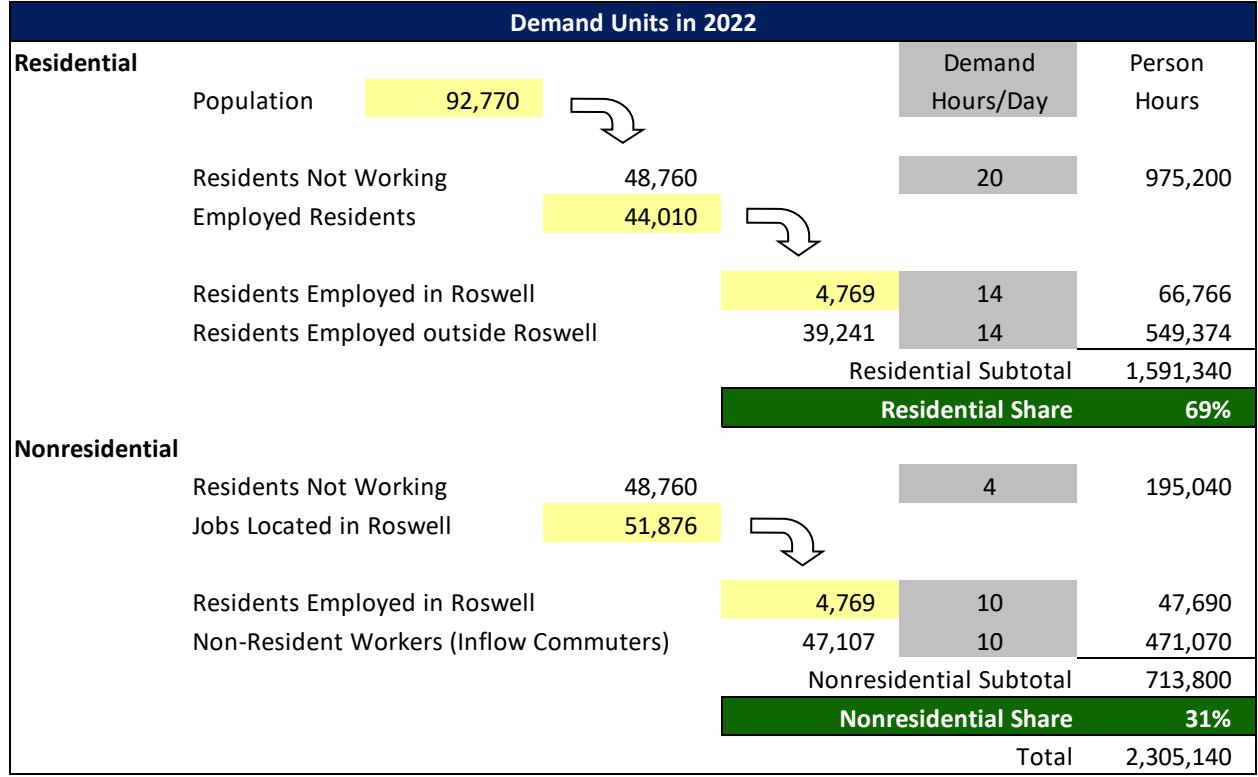

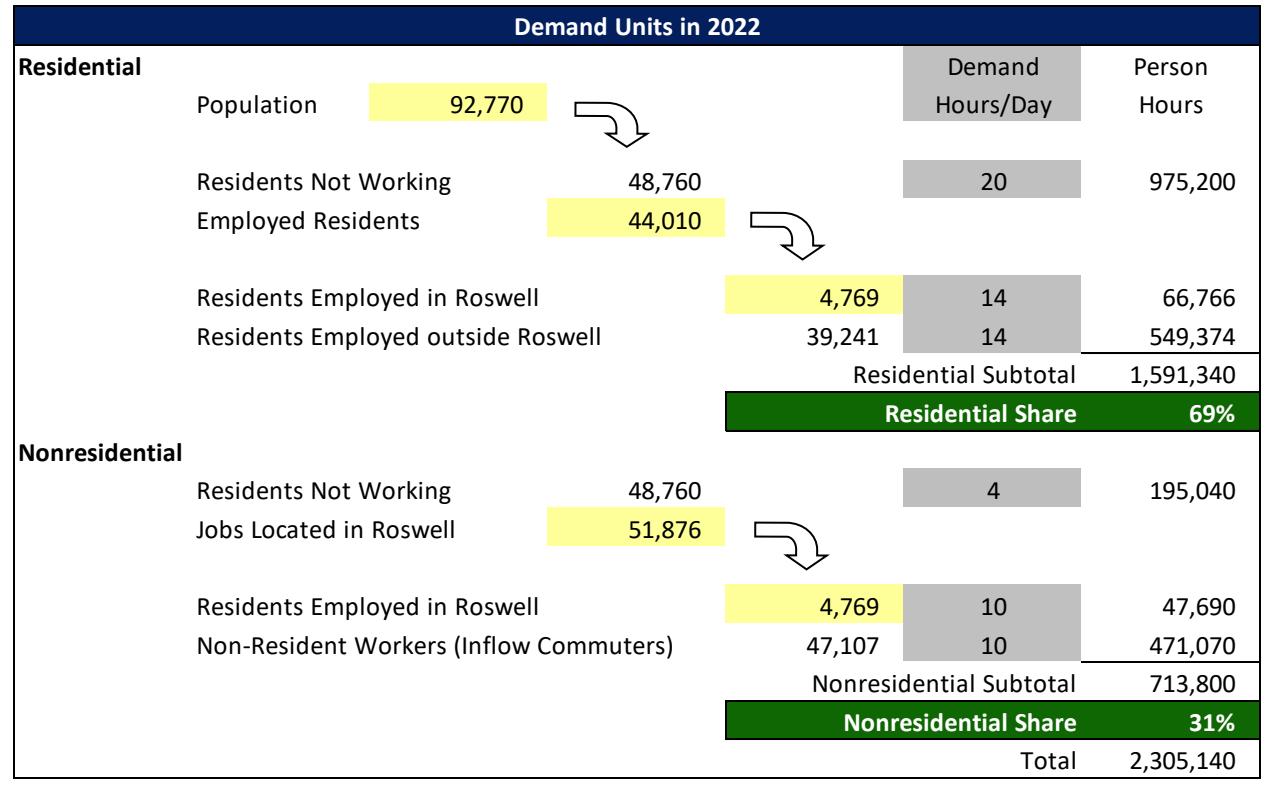

PROPORTIONATE SHARE

SERVICE UNITS

POLICE FACILITIES - INCREMENTAL EXPANSION

PROJECTED DEMAND FOR GROWTH-RELATED POLICE INFRASTRUCTURE 25

Police Facilities

CREDITS

MAXIMUM ALLOWABLE POLICE IMPACT FEES

PROJECTED POLICE IMPACT FEE REVENUE

FIRE IMPACT FEE

METHODOLOGY

PROPORTIONATE SHARE

SERVICE UNITS

FIRE FACILITIES - INCREMENTAL EXPANSION

FIRE APPARATUS - INCREMENTAL EXPANSION

PROJECTED DEMAND FOR GROWTH-RELATED FIRE INFRASTRUCTURE

Fire Facilities

Fire Apparatus CREDITS

MAXIMUM ALLOWABLE FIRE IMPACT FEES

PROJECTED FIRE IMPACT FEE REVENUE

I ROJECTED FIRE IMPACT FEE REVENUE

TRANSPORTATION IMPACT FEE 41

Proportionate Share 41

Service Area 41

TRANSPORTATION DEMAND INDICATORS 41

Residential Trip Generation Rates 41

Nonresidential Trip Generation Rates

Trip Rate Adjustments 42

Commuter Trip Adjustment

Adjustment for Pass-By Trips

Estimated Average Weekday Vehicle Trips

Mode Share and Vehicle Occupancy

Calculation of Person Trips

Estimated Average Weekday Person Trips

Projected Travel Demand

ANALYSIS OF CAPACITY, USAGE, AND COSTS OF EXISTING PUBLI c Services 48

Roadway Improvements 48

Pedestrian Improvements 49

Cost Allocation

CREDITS 51

MAXIMUM ALLOWABLE TRANSPORTATION IMPACT FEES 51

PROJECTED TRANSPORTATION IMPACT FEE REVENUE 53

APPENDIX A: LAND USE DEFINITIONS 54

RESIDENTIAL DEVELOPMENT 54

NONRESIDENTIAL DEVELOPMENT 55

APPENDIX B: LAND USE ASSUMPTIONS 5 6

SUMMARY OF GROWTH INDICATORS 56

SERVICE AREAS 57

RESIDENTIAL DEVELOPMENT

Persons per Housing Unit

Residential Estimates

Residential Projections

Nonresidential Development

Nonresidential Square Footage Estimates

Nonresidential Estimates

Nonresidential Projections

DEVELOPMENT PROJECTIONS

EXECUTIVE SUMMARY

Roswell, Georgia, contracted with TischlerBise, Inc., to analyze the impacts of future development on capital facilities and calculate impact fees based on that analysis. Impact fees are one-time payments used to construct system improvements needed to accommodate future development. The impact fee represents future development's proportionate share of infrastructure costs. Impact fees may be used for infrastructure improvements or debt service for growth-related infrastructure. In contrast to general taxes, impact fees may not be used for operations, maintenance, replacement, or correcting existing deficiencies.

The Georgia Development Impact Fee Act (O.C.G.A. 1) sets forth the foundation local jurisdictions must follow in order to develop and implement a development impact fee program. Accordingly, Roswell has developed its land use/growth pattern projections and assumptions in accordance with Georgia law with specific guidance provided by the Georgia Department of Community Affairs with the update, preparation, and submittal of the "Roswell Comprehensive Plan".

The City of Roswell has experienced steady residential and nonresidential growth in recent years, and this growth is expected to continue. As a result, Roswell must plan for future infrastructure improvements if existing levels of service are to be maintained. This report includes the following infrastructure categories:

- Recreation & Parks

- Police

- Fire

- Transportation

CAPITAL IMPROVEMENT ELEMENT

This document, the Roswell Impact Fee Report, will serve as the basis for the Capital Improvement Element of the Roswell Comprehensive Plan. As such it provides a guide for the efficient use of public funds that are to be invested in roads and streets. The investment in the facilities presented in this report will significantly contribute to the quality of life in Roswell for both the residential and commercial citizens and for future populations as well.

The projects to be presented in the CIE and projected costs are based on current conditions and development patterns and form the basis for the nexus of the Transportation Impact Fees calculated in this report. As the development in the Roswell community occurs, the assumptions and recommendations made as part of this study will need to be updated periodically to ensure that they align with actual development patterns.

GENERAL LEGAL FRAMEWORK

Both state and federal courts have recognized the imposition of impact fees on development as a legitimate form of land use regulation, provided the fees meet standards intended to protect against regulatory takings. Land use regulations, development exactions, and impact fees are subject to the Fifth Amendment prohibition on taking of private property for public use without just compensation. To comply

with the Fifth Amendment, development regulations must be shown to substantially advance a legitimate governmental interest. In the case of impact fees, that interest is in the protection of public health, safety, and welfare by ensuring that development is not detrimental to the quality of essential public services. The means to this end are also important, requiring both procedural and substantive due process. The process followed to receive community input, with stakeholder meetings, work sessions, and public hearings provide opportunity for comments and refinements to the impact fees.

There is little federal case law specifically dealing with impact fees, although other rulings on other types of exactions (e.g., land dedication requirements) are relevant. In one of the most important exaction cases, the U. S. Supreme Court found that a government agency imposing exactions on development must demonstrate an "essential nexus" between the exaction and the interest being protected (see Nollan v. California Coastal Commission, 1987). In a more recent case (Dolan v. City of Tigard, OR, 1994), the Court ruled that an exaction also must be "roughly proportional" to the burden created by development. However, the Dolan decision appeared to set a higher standard of review for mandatory dedications of land than for monetary exactions such as impact fees.

There are three reasonable relationship requirements for impact fees that are closely related to "rational nexus" or "reasonable relationship" requirements enunciated by a number of state courts. Although the term "dual rational nexus" is often used to characterize the standard by which courts evaluate the validity of impact fees under the U.S. Constitution, TischlerBise prefers a more rigorous formulation that recognizes three elements: need, benefit, and proportionality. The dual rational nexus test explicitly addresses only the first two, although proportionality is reasonably implied, and was specifically mentioned by the U.S. Supreme Court in the Dolan case. Individual elements of the nexus standard are discussed further in the following paragraphs.

All new development in a community creates additional demands on some, or all, public facilities provided by local government. If the capacity of facilities is not increased to satisfy that additional demand, the quality, or availability, of public services for the entire community will deteriorate. Impact fees may be used to recover the cost of growth-related facilities, but only to the extent that the need for facilities is a consequence of development that is subject to the fees. The Nollan decision reinforced the principle that development exactions may be used only to mitigate conditions created by the developments upon which they are imposed. That principle clearly applies to impact fees. In this study, the impact of development on infrastructure needs is analyzed in terms of quantifiable relationships between various types of development and the demand for specific facilities, based on applicable level-of-service standards.

The requirement that exactions be proportional to the impacts of development was clearly stated by the U.S. Supreme Court in the Dolan case (although the relevance of that decision to impact fees has been debated) and is logically necessary to establish a proper nexus. Proportionality is established through the procedures used to identify growth-related facility costs, and in the methods used to calculate impact fees for various types of facilities and categories of development. The demand for facilities is measured in terms of relevant and measurable attributes of development (e.g., a typical housing unit's average weekday vehicle trips).

A sufficient benefit relationship requires that impact fee revenues be segregated from other funds and expended only on the facilities for which the fees were charged. Impact fees must be expended in a timely manner and the facilities funded by the fees must serve the development paying the fees. However, nothing in the U.S. Constitution or the state enabling legislation requires that facilities funded with fee revenues be available exclusively to development paying the fees. In other words, benefit may extend to a general area including multiple real estate developments. These procedural, as well as substantive, issues are intended to ensure that new development benefits from the impact fees they are required to pay. The authority and procedures to implement impact fees is separate from and complementary to the authority to require improvements as part of subdivision or zoning review.

GEORGIA DEVELOPMENT IMPACT FEE ACT

The Georgia Development Impact Fee Act (DIFA) requires that development impact fees be determined in a manner that ensures a reasonable correlation or relationship (nexus) between the fee levied and the specific capital improvements to be constructed. Since different communities have different facility and infrastructure needs, it is not unusual for impact fees to vary from one jurisdiction to another. In summary, legally defensible impact fees in Georgia must:

- § Be in compliance with the Georgia Development Impact Fee Act.

- § Not be arbitrary or discriminatory.

- § Not be based on the relationship of the impact fee charged and the benefits received by the fee payer.

- § Be used to finance new facilities/infrastructure needed to serve new development.

- § Not exceed the proportionate share of the cost of the facilities needed to serve new residents or developments (i.e. nexus).

Under DIFA, Roswell must:

- § Use impact fee revenues appropriately:

- o Only for expansion of facilities and infrastructure.

- o Never for O & M expenses.

- § Establish a Capital Improvement Program also referred to as the Capital Improvement Element which includes a Schedule of Improvements also known as the Short-Term Work Program (STWP).

- § Establish impact fee accounts (cannot be co-mingled with other City funds).

- § Establish an Advisory Committee to assist and advise with regard to the adoption of an impact fee ordinance.

- § Establish service area districts

- § Prepare an annual report in conjunction with the annual audit.

- § Update the Capital Improvement Element on an annual basis.

Attachment: Roswell Impact Fee Report 10.8.25 (Presentation DIFA)

CONCEPTUAL IMPACT FEE CALCULATION

In contrast to project-level improvements, impact fees fund growth-related infrastructure that will benefit multiple development projects, or the entire service area (usually referred to as system improvements). The first step is to determine an appropriate demand indicator for the particular type of infrastructure. The demand indicator measures the number of service units for each unit of development. For example, an appropriate indicator of the demand for parks is population growth and the increase in population can be estimated from the average number of persons per housing unit. The second step in the impact fee formula is to determine infrastructure units per service unit, typically called level-of-service (LOS) standards. In keeping with the park example, a common LOS standard is improved park acres per thousand people. The third step in the impact fee formula is the cost of various infrastructure units. To complete the park example, this part of the formula would establish a cost per acre for land acquisition and / or park improvements.

METHODOLOGY

Impact fees for the capital facilities made necessary by future development must be based on the same level of service (LOS) provided to existing development in the service area. There are three basic methodologies used to calculate impact fees. They examine the past, present, and future status of infrastructure. Each methodology has advantages and disadvantages in a particular situation and can be used simultaneously for different cost components. Reduced to its simplest terms, the process of calculating impact fees involves two main steps: (1) determining the cost of growth-related capital improvements and (2) allocating those costs equitably to various types of development. In practice, though, the calculation of impact fees can become quite complicated because of the many variables involved in defining the relationship between development and the need for facilities within the designated service area. The following paragraphs discuss basic methodologies for calculating impact fees and how those methodologies can be applied.

- § Cost Recovery (past improvements) The rationale for recoupment, often called cost recovery, is that future development is paying for its share of the useful life and remaining capacity of facilities already built, or land already purchased, from which new growth will benefit. This methodology is often used for utility systems that must provide adequate capacity before future development can take place.

- § Incremental Expansion (concurrent improvements) The incremental expansion methodology documents current LOS standards for each type of public facility, using both quantitative and qualitative measures. This approach assumes there are no existing infrastructure deficiencies or surplus capacity in infrastructure. Future development is only paying its proportionate share for growth-related infrastructure. Revenue will be used to expand or provide additional facilities, as needed, to accommodate future development. An incremental expansion cost method is best suited for public facilities that will be expanded in regular increments to keep pace with development.

- § Plan-Based (future improvements) The plan-based methodology allocates costs for a specified set of improvements to a specified amount of development. Improvements are typically identified in a long-range facility plan and development potential is identified by a land use plan. There are two basic

options for determining the cost per demand unit: (1) total cost of a public facility can be divided by total demand units (average cost), or (2) the growth-share of the public facility cost can be divided by the net increase in demand units over the planning timeframe (marginal cost).

EVALUATION OF CREDITS

There are two types of credits that should be addressed in impact fee studies and ordinances. The first type of credit is a revenue credit due to possible double payment situations, which could occur when other revenues may contribute to the capital costs of infrastructure covered by the impact fee. This type of credit is integrated into the fee calculation, thus reducing the amount of the impact fee. The second type of credit is a site-specific credit, or developer reimbursement, for dedication of land or construction of system improvements. This type of credit is addressed in the administration and implementation of the impact fee program. For ease of administration, TischlerBise normally recommends developer reimbursements for system improvements.

Specific policies and procedures related to site-specific credits should be addressed in the ordinance that establishes the impact fees. Project-level improvements, required as part of the development approval process, are not eligible for credits against impact fees. If a developer constructs a system improvement included in the fee calculations, it will be necessary to either reimburse the developer or provide a credit against the fees in the area that benefits from the system improvement. The latter option is more difficult to administer because it creates unique fees for specific geographic areas. Based on national experience, it is better for the City to establish a reimbursement agreement with the developer that constructs a system improvement. The reimbursement agreement should be limited to a payback period of no more than ten years, and the City should not pay interest on the outstanding balance. The developer must provide sufficient documentation of the actual cost incurred for the system improvement. The City should only agree to pay the lesser of the actual construction cost or the estimated cost used in the impact fee analysis. If the City pays more than the cost used in the fee analysis, there will be insufficient fee revenue. Reimbursement agreements should only obligate the City to reimburse developers annually according to actual fee collections from the benefiting area.

IMPACT FEE COMPONENTS

Figure 1 summarizes service areas, methodologies, and infrastructure cost components for the impact fee categories.

Infrastructure

Category Service

Area Cost

Recovery Incremental

Expansion Plan-Based Cost

Allocation

Parks Citywide N/A Park Improvements,

Community Centers N/A Population

Police Citywide N/A Police Facilities N/A Population, Nonres.

Vehicle Trips

Fire Citywide N/A Fire Facilities, Fire

Apparatus N/A Population, Nonres.

Vehicle Trips

Transportation Citywide N/A N/A Roadway Expansion,

Pedestrian Expansion Vehicle Trips, Person

Trips

Calculations throughout this report are based on an analysis conducted using Excel software. Most results are discussed in the report using two, three, and four decimal places, which represent rounded figures. However, the analysis itself uses figures carried to their ultimate decimal places; therefore, the sums and products generated in the analysis may not equal the sum or product if the reader replicates the calculation with the factors shown in the report (due to the rounding of figures shown, not in the analysis).

MAXIMUM ALLOWABLE IMPACT FEES

Impact fees for residential development will be assessed per dwelling unit, based on the type of unit. Nonresidential impact fees will be assessed per 1,000 square feet of floor area, based on the development type. The fees represent the maximum allowable fees. Roswell may adopt fees that are less than the amounts shown; however, a reduction in impact fee revenue will necessitate an increase in other revenues, a decrease in planned capital improvements, and/or a decrease in Roswell's LOS standards. All costs in the Impact Fee Report represent current dollars with no assumed inflation over time. If costs change significantly over time, impact fees should be recalculated.

Figure 2: Maximum Allowable Impact Fees

Residential Development Fees Per Unit

Development Type Recreation

& Parks Police Transportation Admin

(3%) Total

Single Family \$4,249 \$859 \$1,498 \$2,399 \$270 \$9,275

Multi-Family \$3,099 \$627 \$1,092 \$1,714 \$196 \$6,728

Nonresidential Development Fees per 1,000 Square Feet

Development Type Recreation & Parks Police Fire Transportation Admin

(3%) Total

Industrial \$0 \$153 \$266 \$672 \$33 \$1,123

Commercial \$0 \$1,106 \$1,928 \$4,871 \$237 \$8,142

Office & Other Services \$0 \$491 \$856 \$2,162 \$105 \$3,613

Institutional \$0 \$488 \$850 \$2,148 \$105 \$3,590

CHANGES OF LAND USE

As discussed above, the impact fees would be established by ordinance and only assessed against new land uses. Specific policies and procedures related to change of land use and alternative fee calculations should also be contained within the ordinance. For example, if an existing 10,000 square foot industrial building is converted into a new retail space, it is reasonable that the County may want to charge the difference in transportation fee between the old use (industrial) and the new use (retail).

Impact Fee Report and Capital Improvement Element City of Roswell, Georgia

CAPITAL IMPROVEMENT ELEMENT

This document, the Roswell Impact Fee Report, will serve as the basis for the Capital Improvement Element of the Roswell Comprehensive Plan. As such it provides a guide for the efficient use of public funds that are to be invested in parks, police, fire, and transportation infrastructure. The investment in the facilities presented in this report will significantly contribute to the quality of life in Roswell for both the residential and commercial citizens and for future populations as well.

The key component of any Development Impact Fee Program is the establishment of a Capital Improvement Element. Roswell has selected certain projects within the CIP to be included in the CIE for impact fee calculation purposes.

The Capital Improvement Plan is simply a capital improvement budget or spending plan that sets the priority and timing for the construction or purchase of facilities, equipment and/or infrastructure that have been identified as necessary to maintain the current level of service demands from the public and to maintain the overall quality of life within a community.

As with most Capital Improvement Plans, Roswell has developed the current CIP based upon input received from the City's consulting engineers, City staff and input from Roswell residents submitted during the update of the Comprehensive Plan.

The following section provides a summary of the Capital Improvement Plans depicting growth-related capital demands and costs on which the fees are based. Each infrastructure category is discussed in turn. First, Figure 3 and Figure 4 lists the projected growth over the next ten years in Roswell (further details can be found in Appendix B: Land Use Assumptions). As the development in the Roswell community occurs, the assumptions and recommendations made as part of this study will need to be updated periodically to ensure that they align with actual development patterns.

Figure 3. Ten-Year Projected Residential Growth

Daniell CA 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Year

Roswell, GA Base Year 1 2 3 4 5 6 7 8 9 10 Increase

Population

Single Family 71,144 71,638 72,221 72,808 73,400 73,997 74,599 75,206 75,818 76,434 77,056 5,911

Multi-Family 21,092 21,348 21,522 21,697 21,873 22,051 22,231 22,412 22,594 22,778 22,963 1,871

Total 92,236 92,986 93,743 94,505 95,274 96,049 96,830 97,617 98,411 99,212 100,019 7,783

Housing Units

Single Family 26,746 26,932 27,151 27,371 27,594 27,819 28,045 28,273 28,503 28,735 28,968 2,222

Multi-Family 10,872 11,004 11,094 11,184 11,275 11,367 11,459 11,552 11,646 11,741 11,837 965

Total 37,618 37,936 38,244 38,555 38,869 39,185 39,504 39,825 40,149 40,476 40,805 3,187

Roswell, GA 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Year

Roswell, GA Base Year 1 2 3 4 5 6 7 8 9 10 Increase

Employment

Industrial 6,111 6,152 6,194 6,236 6,279 6,321 6,364 6,407 6,451 6,495 6,539 428

Commercial 10,762 10,835 10,909 10,983 11,057 11,132 11,208 11,284 11,360 11,438 11,515 753

Office & Other Services 17,492 17,611 17,730 17,851 17,972 18,094 18,217 18,340 18,465 18,590 18,716 1,224

Institutional 13,391 13,482 13,573 13,666 13,758 13,852 13,946 14,040 14,136 14,232 14,328 937

Total 47,756 48,080 48,406 48,735 49,066 49,399 49,734 50,072 50,412 50,754 51,098 3,342

Nonresidential Sq Ft (x1,000)

Industrial 4,296 4,332 4,368 4,404 4,441 4,477 4,515 4,552 4,589 4,627 4,665 370

Commercial 6,409 6,443 6,478 6,513 6,548 6,583 6,619 6,654 6,690 6,727 6,763 355

Office & Other Services 7,516 7,552 7,589 7,626 7,663 7,701 7,738 7,776 7,814 7,853 7,892 376

Institutional 3,986 4,018 4,050 4,082 4,114 4,147 4,180 4,213 4,247 4,280 4,314 328

Figure 4. Ten-Year Projected Nonresidential Growth

The Georgia Development Fee Act (O.C.G.A. § 1et seq.) details items necessary in a Capital Improvement Element, shall include, but not be limited to, the following items:

- Projection of Needs: A projection of needs for system improvements during a planning horizon established in the comprehensive plan. To ensure consistency, the time frame used for projecting infrastructure needs shall coincide with the planning horizon used for the remainder of the comprehensive plan.

- Schedule of Improvements: A schedule of capital improvements intended to meet the projected needs for system improvements identified in the comprehensive plan. At a minimum, improvements shall be scheduled over a five-year period, coinciding with the initial Short Term Work Program developed in the comprehensive plan. Thereafter, local governments shall annually update and maintain, at a minimum, a five-year schedule of system improvements within the Capital Improvements Element of their comprehensive plans.

- Description of Funding Sources: A description of anticipated funding sources for each required improvement.

- Designation of Service Areas and Levels of Service: The designation of one or more service areas within the community and the assignment of levels of service for public facilities within each service area. Once assigned to each service area, levels of service shall be used as the basis for calculating impact fees.

A summary of the impact fee related capital improvement plan (CIP) for each infrastructure category included in the study is provided below. Additionally, the City of Roswell annually prepares a larger CIP which includes items that are not impact fee eligible such as replacement of existing capital assets.

RECREATION & PARKS

The Recreation & Parks development impact fee is based on the existing level of service provided for park improvements and community centers. Listed in the Recreation & Parks CIP (Figure 5), to serve projected growth at current levels of service, the City plans to purchase or construct new park improvements. The Recreation & Parks Department also plans to renovate and expand capacity within existing community centers—particularly the Crabapple Center—to support program growth, rather than building new

City of Roswell, Georgia

centers. It is expected that the CIP will be updated to reflect the demand for Recreation & Parks facilities based on the current level of service provided should demand be higher or lower than projected need.

Figure 5. Recreation & Parks Year Growth-Related CIP

0?AB"=(\$%F'=C,\$>""\$8='I,=D\$ND=+ .+I,- 0?AB"=(\$!""F 8)-,\$'"(\$.+I, 8)-,

!"#\$%F'()"F"+,-

!"#\$%F'()"F"+,- .+I,- 01 20134153 2646574153

!"#\$8)FF9+I,:\$8"+,"(-

!"#\$8)FF9+I,:\$8"+,"(- ;"", 074070 276? 20?40@74063

!"#\$% &'()+,)-.

POLICE

The Police development impact fee is based on the current level of service for police station space. Listed in the Police CIP (Figure 6), to serve projected growth at current levels of service, the City plans to purchase or construct new police facilities space. There are currently plans to expand the current 911 Call Center in order to accommodate increased demand for emergency response. It is expected that the CIP will be updated to reflect the demand for Police facilities based on the current level of service provided should demand be higher or lower than projected need.

Figure 6. Police Year Growth-Related CIP

:4@A"FI\$CD=F'\$%""\$

;F=(F)\$N)F? >?(+ :4@A"FI\$!""B ;?( ;Figure 7. Fire Year Growth-Related CIP

?5@A"'(\$BCF':)\$9""\$

D'F.)';\$N;'- ,)+ ?5@A"'(\$!""F DG+)\$F"(\$,) DG+)

!"#\$%FF'(')+

!"#\$%FF'(')+ ,)+ I 07478743I2

!"#\$9':.;.)."+

!"#\$9':.;.)."+ 4I6> 0>53 0348?34126

!"#\$% &'()+(,)+

TRANSPORTATION

The transportation development impact fee is broken down into two CIPs to account for the different methodologies applied to the roadway and pedestrian components. Listed in Figure 8 is the City's the tenyear CIP for roadway expansion. The total CIP cost is \$155.9 million, keeping in mind that this CIP has omitted projects that are not impact fee eligible to some extent (projects that do not expand capacity).

Figure 8. Roadway Year Growth-Related CIP

Category Roadway Projects Cost

Intersection Alpharetta Hwy (@ Hembree Rd) \$900,000

Intersection Alpharetta Hwy (@ Hill St) \$45,000

Intersection Alpharetta Hwy (@ Mansell Rd) \$45,000

Intersection Alpharetta Hwy (@ Norcross St) \$20,000

Intersection Alpharetta Hwy (@ Upper Hembree Rd) \$20,000

Intersection Canton Street (@ Webb St) \$900,000

Intersection Crabapple Road (@ Hembree Rd) \$4,075,000

Intersection Crossville Road (@ Crabapple Rd) \$35,000

Intersection Grimes Bridge Road (@ Dogwood Rd) \$1,465,214

Intersection Hardscrabble Road (@ Etris Rd) \$20,000

Intersection Hardscrabble Road (@ King Rd) \$4,075,000

Intersection Holcomb Bridge Road (@ Alpharetta Hwy) \$35,000

Intersection Holcomb Bridge Road (@ Dogwood Rd) \$19,673,722

Intersection Holcomb Bridge Road (@ Old Alabama Rd) \$150,000

Intersection Holcomb Bridge Road (@ Warsaw Rd) \$8,991,743

Intersection Houze Rd (@ Crabapple Rd) \$50,000

Intersection Houze Rd (@ Mansell Rd) \$2,000,000

Intersection Mansell Road (@ Colonial Center Pwky) \$20,000

Intersection Mansell Road (@ Warsaw Rd) \$50,000

Intersection Marietta Hwy (@ Willeo Rd) \$20,000

Intersection Old Alabama Road (@ Roxburgh Dr) \$8,500,000

Intersection Old Roswell Road (@ Old Roswell Pl) \$350,000

Intersection Riverside Rd (@ Dogwood Rd) \$4,075,000

Intersection SR 9/120 (Village Center) \$12,968,467

Intersection Woodstock Rd (@ Mtn. Park) \$30,000

Realignments Big Creek Pkwy (Phase III) \$63,956,100

Realignments Commerce Parkway \$2,081,490

Realignments Houze Road \$4,827,256

Realignments Mansell Road \$13,685,230

Realignments Old Ellis/Sun Valley Connector \$2,119,491

Realignments Riverwalk Emergency Access \$154,355

Realignments Sun Valley/Houze Connector \$550,518

Total \$155,888,586

Source: City of Roswell Transportation Master Plan, 2023.

\ One a case by case basis the City will determine the extent to which a project is impact fee eligible. The portion of the project that is not expanding the capacity of the parks system is not impact fee eligible.

Figure 9 is the year CIP for pedestrian expansion projects. The total CIP cost is \$69.8 million, keeping in mind that this CIP has omitted projects that are not impact fee eligible to some extent (projects that do not expand capacity).

Figure 9. Pedestrian Year Growth-Related CIP

Category Pedestrian Projects Cost

Corridor Canton Street \$2,500,000

Corridor Cherry Way \$1,061,333

Corridor Green Street \$1,988,898

Corridor Warsaw Road Safety Improvements \$1,662,363

Corridor Webb Street \$4,561,000

Bicycle/Pedestrian Canton Street \$126,298

Bicycle/Pedestrian Crabapple Rd \$2,131,634

Bicycle/Pedestrian Crabapple Rd/Canton St \$1,720,120

Bicycle/Pedestrian East Roswell Trail \$3,708,204

Bicycle/Pedestrian Elkins Rd \$2,737,144

Bicycle/Pedestrian Grimes Bridge Rd \$2,142,451

Bicycle/Pedestrian Grimes Bridge Rd \$2,350,536

Bicycle/Pedestrian Grimes Bridge Rd \$1,521,133

Bicycle/Pedestrian Hembree Rd \$4,972,250

Bicycle/Pedestrian Hog Wallow Creek \$2,177,952

Bicycle/Pedestrian Hog Wallow Creek \$2,726,245

Bicycle/Pedestrian Hog Wallow Creek \$4,115,609

Bicycle/Pedestrian Holcomb Bridge Rd \$100,000

Bicycle/Pedestrian Holcomb Bridge Rd \$4,139,969

Bicycle/Pedestrian Holcomb Bridge Rd \$4,269,630

Bicycle/Pedestrian Holcomb Woods Pkwy \$50,000

Bicycle/Pedestrian Jones Rd \$415,000

Bicycle/Pedestrian Market Boulevard \$2,713,378

Bicycle/Pedestrian Mimosa Blvd/Oxbo Rd \$2,597,286

Bicycle/Pedestrian Norcross St \$1,707,544

Bicycle/Pedestrian Norcross St \$2,236,178

Bicycle/Pedestrian N-S Corridor \$2,581,679

Bicycle/Pedestrian Old Roswell Cemetary Trail \$417,574

Bicycle/Pedestrian Old Roswell Rd \$1,849,055

Bicycle/Pedestrian Warsaw Rd \$2,567,271

Bicycle/Pedestrian Willeo Rd \$1,956,233

Total \$69,803,967

Source: City of Roswell Transportation Master Plan, 2023.

\ One a case by case basis the City will determine the extent to which a project is impact fee eligible. The portion of the project that is not expanding the capacity of the parks system is not impact fee eligible.

FUNDING SOURCES FOR CAPITAL IMPROVEMENTS

In determining the proportionate share of capital costs attributable to new development, the Georgia Development Fee Act states that local governments must detail anticipated funding sources for each required improvement. The following are other sources of revenue that were accounted for in the impact fee study:

- § The TSPLOST I is a capital projects fund used to track projects funded by Transportation Special Purpose Local Option Sales Tax (TSPLOST). On November 8, 2016, Fulton County voters approved the T-SPLOST referendum to fund transportation projects in their cities. In April 2017, collection of a 0.75% (3/4 of a cent) sales tax was implemented to fund transportation projects specifically recommended by each Fulton County city.

- § The TSPLOST II Project Fund is a capital projects fund used to track projects funded by the second round of Transportation Special Purpose Local Option Sales Tax (TSPLOST). At the June 14, 2021, City Council meeting, the City of Roswell's elected officials approved a list of eligible projects for TSPLOST II.

- § General Fund transfers are the other major source of capital revenue for the City. The City will continue leveraging this source to help fund portions of future CIPs.

- § The City of Roswell has existing balances in its impact fee funds. These balance will be used in the to fund previous growth's portion of the City's CIPs. While future impact fee collection will fund future growth's portion of the CIPs. In this case, a credit is not necessary

RECREATION & PARKS IMPACT FEE

METHODOLOGY

The Georgia Development Fee Act § 2(17)(C) includes the following public facilities:

"Parks, open space and recreation areas, and related facilities."

The Recreation & Parks impact fee includes components for park improvements and community centers. Both components of the Recreation & Parks impact fee use the incremental expansion methodology. A component for land is not included, as the City does not anticipate purchasing additional park land in the next five years. Rather, the focus will be on improving existing undeveloped park land.

PROPORTIONATE SHARE

TischlerBise recommends allocating 100 percent of the cost of parks infrastructure to residential development since nonresidential development generates negligible demand for parks infrastructure.

SERVICE UNITS

Residential impact fees are calculated on a per capita basis, then converted to an appropriate amount for each type of housing unit based on the number of persons per housing unit (PPHU). As shown in Figure 10, the current PPHU factors are 2.66 persons per single family unit and 1.94 persons per multi-family unit. These factors are based on the U.S. Census Bureau's 2023 American Community Survey (ACS) year estimates (see Appendix B).

Figure 10: Recreation & Parks Service Units

@FA9<#9';FA'

=FLF%<;F#1'?+;F B<09"#\$'8#"13

!"#\$%F'()"%+ H

/0%1"2()"%+ 45

'!FF'6)#7'89F':990\;1"<#9

PARK IMPROVEMENTS – INCREMENTAL EXPANSION

The City of Roswell plans to expand its current inventory of 208 park improvements to serve future development. This analysis allocates 100 percent of demand for park improvements to residential development. Roswell's existing level of service is 0.0023 improvements per person (208 improvements x 100 percent residential share / 92,236 persons).

Based on a total replacement cost of \$38,443,300 for Roswell's existing 208 park improvements, the average replacement cost is \$184,824 per improvement. For park improvements, the cost is \$416.79 per person (0.0023 improvements per person x \$184,824 per improvement).

Figure 11: Park Improvements Level of Service

!"#\$%FG(F) +HG%)-"H"(# .F(I0)#( 1"G23\$"H"(I0)#(

4H322I!F3H)5I6F"25 77 89:;8; 8;

I)\$\$"I0)B%(IJOB(5))%L : 87C

P)22"QO322I0)B%(IJOB(5))%L C 8A=

4G23#RG35 C 8H==

P)22"QO322I0)B%(IJ+5))%L H 87A=

M))2 7 8A==

+HG%)-"H"(#IG"%IM"%#)

=R==C:

."/#01230423/"5

)+*6789

4)B%\$"[I0F(QI)FI1)#\"22

COMMUNITY CENTERS – INCREMENTAL EXPANSION

The City of Roswell plans to expand its current inventory of 191,532 square feet of community centers to serve future development. This analysis allocates 100 percent of demand for community centers to residential development. Roswell's existing level of service is 2.0765 square feet per person (191,532 square feet x 100 percent residential share / 92,236 persons).

Based on the City's Facilities Condition Assessments and conversations with City staff, a total replacement cost of \$120,602,787 was determined for Roswell's existing 191,532 square feet of community centers, the average replacement cost is \$630 per square foot. For community centers, the cost is \$1,307.55 per person (2.0765 square feet per person x \$630 per square foot).

Figure 12: Community Centers Level of Service

!"#\$%FG(F) +,%"/0""( 1)#(2+,3/0(34 5)(.6/1)#(4

7.66"%/8.%9/1)JJ-F(;/1"("%

FG-6(/F,(F\$#/0.\$F6F(;

6(-%.6/F%(#/1"("% =HLCCC A@EC A?ILECCLCCC

F%(/1"("%/7"#(

8))6/N-F6GFQ EL?D@ AH@I A?LH?

TF#6/F%(#/1"("% LAH@I ADL AH@I ADL

!"#\$% &'&()+ ,-. ,&+.(+(/0/

41F(;U#/0.\$F6F(F"#/1)\GF(F)\/F##"##J"(/.GV-#("G/ECP/()/%"X6"\$(/\$-%%"(/\$)#(%-\$(F)\/\$)#(#/Y\$)\O"%#.(F)#/LF(P/1F(;R

1)#(/F66)\$.(F)/0.\$()%#

1)#(/G"%/+,%"/0))( AB=C

R"O"6])X]+"%OF\$"/YRS+R/+(.G.%G#

S[F#(FQ/+,%"/0""(

M"#FG"(F.6

M"#FG"(F.6/+P.%"

?C?E/8)G-6.(F) I?L?=B

+,%"/0""(/G"%/8"%#)

?3CDBH

1"2#345637562"8

,&(./9))

+)-%\$"\/1F(;/)X/M)#L"66

PROJECTED DEMAND FOR GROWTH-RELATED PARKS INFRASTRUCTURE

Park Improvements**