Mayor and Council Agenda

PDF

Mayor and Council

Sep 08, 2025 at 07:00 PM

Processed: Sep 05, 2025 at 08:59 PM

PDF Content

Pages: 113

City of Roswell Meeting Agenda Mayor and Council Regular Meeting

Mayor Kurt Wilson Councilmember Sarah Beeson Councilmember Christine Hall Councilmember G. Lee Hills Councilmember David Johnson Councilmember William Morthland Councilmember Allen Sells

Monday, September 8, 2025 7:00 PM City Hall -

Council Chambers

Welcome

Roll Call

Invocation/Moment of Silence - Youth Director Dara Vidito, Congregation Beth Hallel

Pledge of Allegiance - United States Air Force Staff Sergeant Monica Graham

Mayor's Report

- 1. #10031 Reading of a Proclamation for the Esteemed Veteran of Roswell Award to United States Air Force Staff Sergeant Monica Graham.

- 2. #9995 Proclamation for Esteemed Roswell Public Safety Employee award to Captain Jeff Mealor as Roswell Fire Company Officer of the Year for 2024.

- 3. #10062 A Proclamation proclaiming September as 2025 Childhood Cancer Awareness Month to increase awareness of childhood cancer and the need for funding and research and to support families in Roswell affected by childhood cancer.

- 4. #10013 Approval of a Planning Commission (PC) appointment - Gurtej Narang.

- 5. #10036 Oath of Office - Gurtej Narang (Planning Commission).

- 6. #10030 Roswell Results Update.

Consent Agenda

1. #10034 Approval of the minutes of the August 25, 2025 Special Called Mayor and Council meeting and August 25, 2025 Regular Mayor and Council meeting.

Regular Agenda

1. #10043 Approval of an Ordinance to Adopt a Millage Rate of 4.949 for Tax Year 2025. (First Reading)

Presented by Bill Godshall, Chief Financial Officer

2. #10026 Approval of a Resolution for issuance of Downtown Development Authority (DDA) Revenue Bonds and Intergovernmental Contract between the City of Roswell and the DDA to finance the Hill Street parking deck.

Presented by Joseph Cusack, Assistant City Attorney

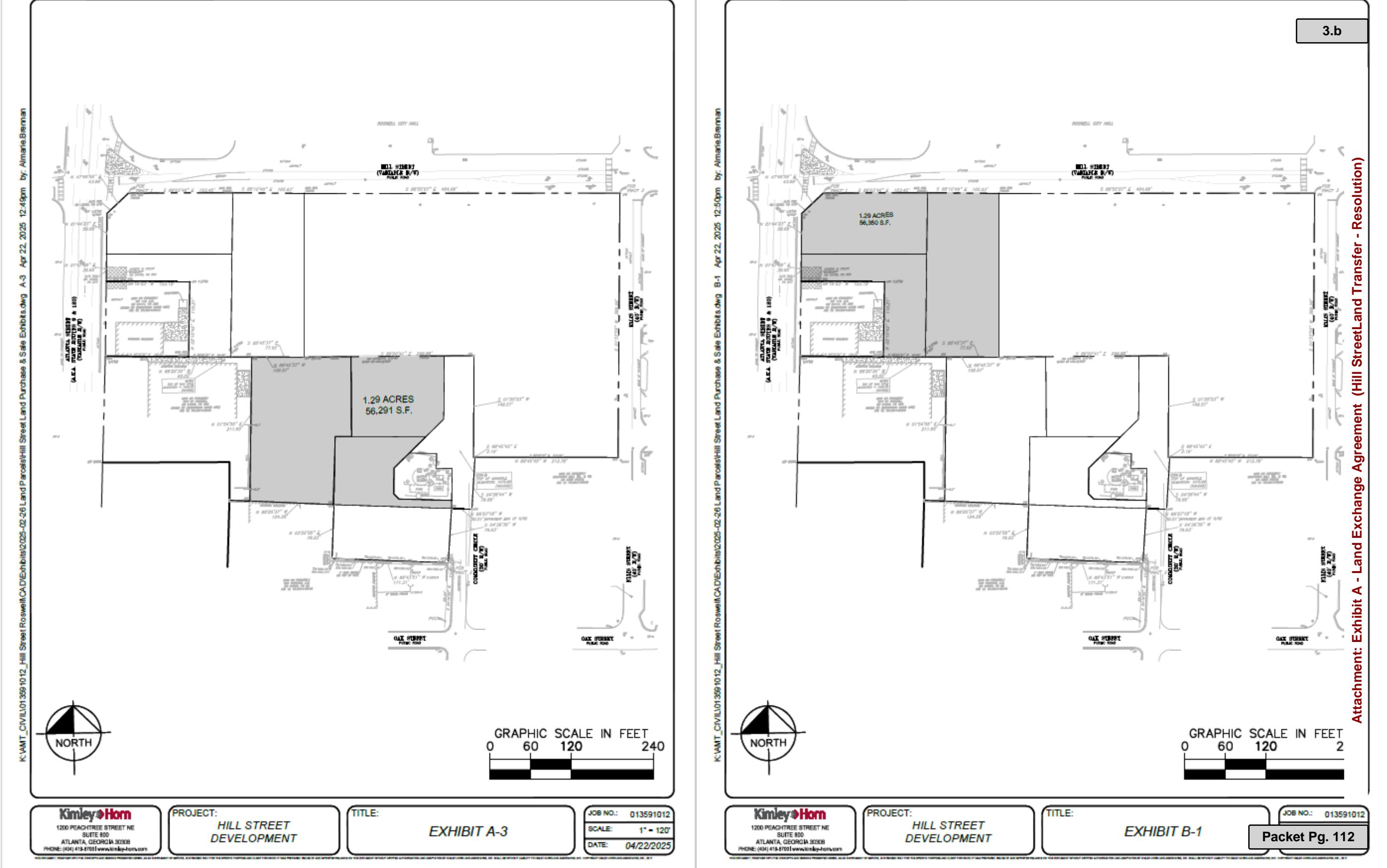

3. #10027 Resolution Authorizing the Mayor or City Administrator with the City Attorney's Office to close on the Hill Street Land Exchange Agreement.

Presented by Joseph Cusack, Assistant City Attorney

City Attorney's Report

4. #10033 Recommendation for Closure to Discuss Personnel, Litigation and Real Estate.

Adjournment

PUBLIC COMMENT PROTOCOL:

- To address Mayor and Council on an Agenda Item, complete a Comment Card and submit to the City Clerk.

- Comments by individual speakers are limited to five minutes per item. (Exemptions to the time limit are zoning applicants, appeals, and semi-judicial matters before Mayor and Council.). Comments should only be made on the agenda item under consideration.

- Documents, pictures or presentation materials for distribution to the Mayor and Council must be submitted to the City Clerk by noon on Monday prior to the meeting. Email to citizendocuments@roswellgov.com or drop off at City Hall.

RULES OF DECORUM FOR ALL MEETINGS (City of Roswell Code of Ordinances Section 2.1.6):

The City of Roswell strives to provide a positive experience for those visiting city facilities and promotes an environment of personal safety and security – free from intimidation, threats or violent acts. All are expected to exhibit common courtesy, civility, and respect for others. Members of the audience will respect the rights of others and will not create noise or other disturbances that disrupt or disturb persons who are addressing the Mayor & Council who are speaking or otherwise impede the orderly conduct of the meeting. Violations may result in the violator being removed from the premises.

Mayor and Council

AGENDA ITEM REPORT

ID # - 10031

MEETING

DATE: September 8, 2025

DEPARTMENT: Administration

ITEM TYPE: Proclamation -

Mayor's Report

Reading of a Proclamation for the Esteemed Veteran of Roswell Award to United States Air Force Staff Sergeant Monica Graham.

Item Summary:

This Proclamation honors United States Air Force Staff Sergeant Monica Graham's service to our nation, to fellow service members and to the Roswell community.

Presented by:

Mayor Kurt M. Wilson

Staff Sergeant Monica Graham Esteemed Veteran of Roswell

WHEREAS, the City of Roswell proudly recognizes the bravery, dedication, and selfless service of our veterans who have worn the uniform of the United States Armed Forces in defense of freedom and democracy; and

WHEREAS, Monica Graham began her distinguished military service in 2001 at the age of 18, completing basic training at Lackland Air Force Base in Texas, and serving honorably as a Transportation Apprentice and later a Journeyman in the United States Air Force; and

WHEREAS, Staff Sergeant Monica Graham served her nation with valor during two major conflicts, deploying to Pakistan in support of Operation Enduring Freedom from 2002–2003, and to Iraq in support of Operation Iraqi Freedom from 2004–2005; and

WHEREAS, during her deployments, Staff Sergeant Graham's exemplary performance earned her the Air Force Achievement Medal, a recognition of her courage, skill, and devotion to duty while serving in austere and challenging environments; and

WHEREAS, following her active-duty service from 2001–2005, Monica Graham continued to serve her country with distinction in the Air National Guard from 2008–2013, further demonstrating her enduring commitment to the security of our nation; and

WHEREAS, after her military service, Monica Graham pursued higher education, earning a Political Science degree from the University of South Carolina and a Master of Public Administration from the University of Illinois at Chicago, and in 2025 obtained her Real Estate Salesperson License, continuing a professional career marked by both public service and private-sector achievement; and

WHEREAS, a devoted member of the Roswell community, Monica Graham volunteers with the Youth Program at Fellowship Bible Church and supports her daughter's sports teams through Roswell Recreation, embodying the values of service, mentorship, and civic responsibility; and

WHEREAS, the City of Roswell, its Mayor and Council, and all citizens are deeply grateful for the sacrifices and achievements of Monica Graham, whose life of service exemplifies the highest ideals of patriotism, leadership, and community dedication.

NOW THEREFORE, I, Kurt M. Wilson, Mayor of the City of Roswell, do hereby name Staff Sergeant Monica Graham an Esteemed Veteran of Roswell, and call upon all our citizens to recognize his outstanding service to our country and our community and that there is no higher calling than those who serve in the Armed Forces.

IN WITNESS WHEREOF, I have hereunto set my hand and seal this 8th day of September 2025.

MAYOR KURT M. WILSON

Mayor and Council

AGENDA ITEM REPORT

ID # - 9995

MEETING DATE: September 8, 2025

DEPARTMENT: Mayor's Report

ITEM TYPE: Proclamation - Mayor's Report

Proclamation for Esteemed Roswell Public Safety Employee award to Captain Jeff Mealor as Roswell Fire Company Officer of the Year for 2024.

Item Summary:

This Proclamation recognizes Captain Jeff Mealor as Roswell Fire Company Officer of the Year for 2024 for his outstanding service and commitment to the City of Roswell.

Presented by: Mayor Kurt M. Wilson

ROSWELL FIRE COMPANY OFFICER JEFF MEALOR

- WHEREAS, Captain Jeff Mealor has been selected by his peers as the 2024 Fire Company Officer of the Year, in recognition of his leadership, unwavering professionalism, and commitment to excellence; and

- WHEREAS, Captain Jeff Mealor leads by example, consistently demonstrating integrity, accountability, and respect while inspiring those around him through action, mentorship, and a calm, confident presence under pressure; and

- WHEREAS, Captain Jeff Mealor exemplifies the core values of the City of Roswell Fire Department:

- Service We serve others before ourselves

- Teamwork We are #OneTeam at Roswell Fire Department.

- Accountability We are accountable for our actions and those of our team.

- Integrity We earn trust through our actions.

- Respect We embrace our differences and are considerate of others. And;

- WHEREAS, through distinguished service, Captain Jeff Mealor has earned the respect of both peers and leadership, consistently advancing the mission of the department while cultivating a culture of trust, excellence, and support; and

- WHEREAS, Captain Jeff Mealor demonstrates exceptional leadership by promoting operational readiness through proactive planning, decisive action, and a commitment to maintaining the highest standards of performance and preparedness; and

- WHEREAS, Captain Jeff Mealor leads by example, fostering a culture of integrity, accountability, and respect that strengthens team cohesion and ensures mission success.

NOW, THEREFORE, I, Kurt M. Wilson, Mayor of the City of Roswell, do hereby recognize and honor Captain Jeff Mealor for his outstanding service and call upon all our employees and citizens to recognize his outstanding service and unwavering commitment to the City of Roswell, Georgia.

IN WITNESS WHEREOF I have hereunto set my hand and seal this 8th day On September 2025

\\\\\\\\\\\\\\\\\\\\ MAYOR KURT M. WILSON

2.a

Mayor and Council

AGENDA ITEM REPORT

ID # - 10062

MEETING

DATE: September 8, 2025

DEPARTMENT: Mayor's Report

ITEM TYPE: Proclamation -

Mayor's Report

A Proclamation proclaiming September as 2025 Childhood Cancer Awareness Month to increase awareness of childhood cancer and the need for funding and research and to support families in Roswell affected by childhood cancer.

Item Summary:

Childhood Cancer Awareness Month (CCAM) is recognized in September with the goal to increase awareness of childhood cancer, the need for more funding and research, and to support those families in Roswell affected by childhood cancer, in honor and in memory of the children who have or are courageously battling pediatric cancer.

Presented by:

Mayor Kurt M. Wilson

3.a

WHEREAS: Childhood cancer affects 47 new children each day nationwide, a battle which impacts entire communities including parents, grandparents, siblings, friends, and neighbors. This disease impacts hundreds of children each year in the state of Georgia, including some of Roswell's youngest and most courageous citizens; and

WHEREAS: Childhood Cancer Awareness Month (CCAM) is recognized in September with the goal to increase awareness of childhood cancer, the need for more funding and research, and to support those families in Roswell affected by childhood cancer, in honor and in memory of their children; and

WHEREAS: Families who have a son or daughter who are fighting or have fought active childhood cancer treatment often experience long term effects from the treatments that have helped them survive, and need additional emotional and medical care long after the final treatments are completed; and

WHEREAS: Families who have had a son or daughter pass away from childhood cancer often choose to honor their loved children by continuing to fight against childhood cancer, like community member Millie Mracek who passed away at age 3.5 years old in 2021. Her family started the Mighty Millie Foundation to continue funding research as well as spreading joy and awareness for families fighting childhood cancer; and

WHEREAS: Family support, research and advancements in childhood cancer are often funded by private charities run by individuals who have personally witnessed the long term effects and outcomes of childhood cancer; and

WHEREAS: Many health care providers, charitable organizations, religious, and social groups come together during the month of September to host events, raise funds for research, and offer families physical, emotional, spiritual, and financial support. These groups are committed to supporting families and children through and after the uniquely difficult treatment process; now

THEREFORE: I, Kurt Wilson, Mayor of the City of Roswell, honor our youngest Roswell residents, who have or are courageously battling pediatric cancer, and we proclaim September 2025 as Childhood Cancer Awareness Month and encourage all residents of Roswell to join us in supporting the activities and events throughout the month of September to honor families walking through this journey at every step of the way to let them know that they are brave and they are not alone.

IN WITNESS WHEREOF, I have set my hand and caused the Seal of the City of Roswell to be affixed this 8 th day of September 2025.

Kurt M. Wilson, Mayor

Mayor and Council

AGENDA ITEM REPORT

ID # - 10013

MEETING

DATE: September 8, 2025

DEPARTMENT: Mayor's Report

ITEM TYPE: Appointment

Approval of a Planning Commission (PC) appointment - Gurtej Narang.

Item Summary:

Approval of the appointment of Gurtej Narang to the Planning Commission (PC) to a year term that begins March 14, 2025 and ends March 14, 2028.

Committee or Staff Recommendation: N/A

Financial Impact: N/A

Recommended Motion:

Motion to approve the appointment of Gurtej Narang to the Planning Commission. Authority.

Presented by:

Mayor Kurt M. Wilson

4

Mayor and Council

AGENDA ITEM REPORT

ID # - 10036

MEETING DATE: September 8, 2025

DEPARTMENT: Administration

ITEM TYPE: Swearing In

Oath of Office - Gurtej Narang (Planning Commission).

Item Summary: Oath of Office.

Presented by: Mayor Kurt M. Wilson

Mayor and Council

AGENDA ITEM REPORT

ID # - 10030

MEETING DATE: September 8, 2025 DEPARTMENT: Mayor's Report

ITEM TYPE: Update

Roswell Results Update.

Mayor and Council

AGENDA ITEM REPORT

ID # - 10034

MEETING

DATE: September 8, 2025

DEPARTMENT: Administration

ITEM TYPE: Minutes

Approval of the minutes of the August 25, 2025 Special Called Mayor and Council meeting and August 25, 2025 Regular Mayor and Council meeting.

Item Summary:

Approval of the minutes of the August 25, 2025 Special Called Mayor and Council meeting and August 25, 2025 Regular Mayor and Council meeting.

DRAFT UNAPPROVED

City of Roswell Meeting Minutes Mayor and Council Special Called Meeting

Mayor Kurt Wilson Councilmember Sarah Beeson Councilmember Christine Hall Councilmember G. Lee Hills Councilmember David Johnson Councilmember William Morthland Councilmember Allen Sells

Monday, August 25, 2025 5:00 PM City Hall - Council Chambers

Welcome

Mayor Kurt Wilson: Present, Councilmember Sarah Beeson: Present, Councilmember Christine Hall: Present, Councilmember G. Lee Hills: Present, Councilmember David Johnson: Present, Councilmember William Morthland: Present, Councilmember Allen Sells: Present.

City Attorney's Report

1. #10008 Recommendation for Closure to Discuss Personnel, Litigation and Real Estate.

RESULT: APPROVED [UNANIMOUS]

MOVER: David Johnson, Councilmember

SECONDER: G. Lee Hills, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

Adjournment

The meeting was adjourned at 5:07 PM

1.1.b

City of Roswell Meeting Minutes Mayor and Council Regular Meeting

Mayor Kurt Wilson Councilmember Sarah Beeson Councilmember Christine Hall Councilmember G. Lee Hills Councilmember David Johnson Councilmember William Morthland Councilmember Allen Sells

Monday, August 25, 2025 7:00 PM City Hall -

Council Chambers

Welcome

Mayor Kurt Wilson: Present, Councilmember Sarah Beeson: Present, Councilmember Christine Hall: Present, Councilmember G. Lee Hills: Present, Councilmember David Johnson: Present, Councilmember William Morthland: Present, Councilmember Allen Sells: Present.

Invocation/Moment of Silence - Lead Pastor Dustin Schadt, Northside Church

Pledge of Allegiance - Georgia National Guard Lieutenant Colonel Chris Kehl

Mayor's Report

1. #10006 Reading of a Proclamation for the Esteemed Veteran of Roswell Award to Georgia National Guard Lieutenant Colonel Chris Kehl.

This Proclamation honors Georgia National Guard Lieutenant Colonel Chris Kehl for his service to our Nation, to fellow service members and to the Roswell community.

RESULT: PROCLAMATION READ

2. #10012 Approval of a Historic Preservation Commission appointment - Robert Zappulla.

RESULT: APPROVED [UNANIMOUS]

MOVER: Christine Hall, Councilmember

SECONDER: David Johnson, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

3. #10014 Approval of a Planning Commission (PC) re-appointment - Kitty Singleton.

RESULT: APPROVED [UNANIMOUS]

MOVER: G. Lee Hills, Councilmember

SECONDER: William Morthland, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

1.1.b

4. #10015 Approval of a Recreation Commission (RC) re-appointment - Jose Gonzales.

RESULT: APPROVED [UNANIMOUS]

MOVER: William Morthland, Councilmember

SECONDER: Sarah Beeson, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

5. #10011 Approval of a Roswell Development Authority (RDA) appointment - Tim Houghton.

RESULT: APPROVED [UNANIMOUS]

MOVER: David Johnson, Councilmember

SECONDER: Allen Sells, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

6. #10019 Oath of Office - Robert Zappulla (Historic Preservation Commission), Kitty Singleton (Planning Commission), Jose Gonzales (Recreation Commission) and Tim Houghton (Roswell Development Authority).

RESULT: OATH OF OFFICE READ

7. #10018 Roswell Results Update

- The City of Roswell has been working hard to keep projects moving forward…projects that strengthen our community, grow our economy, and honor those who serve. From new infrastructure to new jobs, from public safety to honoring our heroes, Roswell is delivering on its promise to build a stronger future.

- Just this month, we broke ground on the Downtown Parking Deck at 1054 Alpharetta Street. This \$20 million investment will add nearly 400 parking spaces to ease congestion, support local businesses, and make it easier for residents and visitors to enjoy everything downtown has to offer. And when it's complete, Roswell residents will be able to park there for free.

- We're also proud to welcome PBS Aerospace to Roswell. This global company is hosting its grand opening in Roswell on Sept 4. They are bringing their North American headquarters, manufacturing, and research operations right here to our city. That means up to 200 high-paying jobs in aerospace and advanced technology, and it cements Roswell as a leader in innovation and economic growth.

- Just this past weekend, we came together as a community for the Labonte 5K, honoring Roswell Police Officer Jeremy Labonte, who was tragically killed in the line of duty earlier this year. The race, organized with the Tunnel to Towers Foundation, raised money to support the families of fallen first responders and veterans nationwide. It was a powerful tribute to Jeremy's life and to the sacrifices of our heroes. And just today the City held a formal ceremony dedicating the GA-400 and Holcomb Bridge Road interchange in Officer Labonte's honor. This dedication will serve as a lasting reminder of his service, sacrifice, and commitment to protecting the Roswell community. These tributes to Officer Labonte remind us why investing in public safety is so important. As we honor his service and sacrifice, we are also making sure Roswell's officers have the very best resources to protect and serve our community.

- The Roswell Police Department is settling into its brand-new Public Safety Headquarters. Patrol and Investigations are already operating out of the building, and by the end of the year, almost every division will be under one roof, with 911 moving into its new facility by the end of spring 2026. Our new Public Safety Headquarters give our officers the tools and resources they need to keep our community safe.

1.1.b

- Together, these milestones show Roswell's commitment to progress, innovation, and community. We're investing in infrastructure, bringing in high-quality jobs, honoring our heroes, and strengthening public safety. Roswell is thriving today, and we're building a future that's even stronger.

- We will be showcasing more of these exciting wins on our upcoming web site, roswellresults.com.

Consent Agenda

RESULT: CONSENT AGENDA APPROVED [UNANIMOUS]

MOVER: Sarah Beeson, Councilmember

SECONDER: David Johnson, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

- 1. #10003 Approval of the minutes of the August 11, 2025 Special Called Mayor and Council meeting and August 11, 2025 Regular Mayor and Council meeting.

- 2. #9969 Approval of a Resolution to apply for and accept a 2026 Cultural Facilities Grant from the Georgia Council for the Arts (GCA) and budget authorization to apply for the grant. Resolution No. 30

Regular Agenda

1. #8480 Approval of an Ordinance to Adopt the Roswell Development Finance Program and Guidelines. (Second Reading) Ordinance No. 06

RESULT: APPROVED ON SECOND READING [UNANIMOUS]

MOVER: William Morthland, Councilmember

SECONDER: Allen Sells, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

2. #9936 Approval of an Intergovernmental Assessment Agreement related to the Roswell Development Finance Program (RDFP).

RESULT: APPROVED [UNANIMOUS]

MOVER: William Morthland, Councilmember

SECONDER: Allen Sells, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

3. #9977 Approval of Final Plat 20252121 for Little Lakes Estates located at 385 Pine Grove Road.

RESULT: APPROVED [UNANIMOUS]

MOVER: David Johnson, Councilmember

SECONDER: G. Lee Hills, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

Regular Meeting Monday, August 25, 2025

4. #9466 Approval of a Text and Map Amendment to the Unified

Development Code (UDC) for the Hill Street Overlay (HSOD).

(Second Reading)

Ordinance No. 07

RESULT: APPROVED ON SECOND READING [UNANIMOUS]

MOVER: Allen Sells, Councilmember

SECONDER: William Morthland, Councilmember

IN FAVOR: Beeson, Hall, Hills, Johnson, Morthland, Sells

City Attorney's Report

5. #10005 Recommendation for Closure to Discuss Personnel, Litigation and Real Estate.

Adjournment

The meeting was adjourned at 8:11 PM

1.1.b

City of Roswell

Mayor and Council

AGENDA ITEM REPORT

ID # - 10043

MEETING

DATE: September 8, 2025

DEPARTMENT: Finance

ITEM TYPE: Ordinance -

Millage Rate

Approval of an Ordinance to Adopt a Millage Rate of 4.949 for Tax Year 2025. (First Reading)

Item Summary:

This Ordinance adopts a millage rate of 4.949 (4.049 General Fund Maintenance and Operations and 0.900 Bonded Debt Service).

If the proposed millage rate is formally approved by Mayor and Council, Roswell's property tax rate will continue to be the lowest Maintenance and Operations (M&O) millage rate in 17 years.

Committee or Staff Recommendation:

N/A

Financial Impact: N/A

Recommended Motion:

Motion to approve the first reading of an Ordinance to Adopt a Millage Rate of 4.949 for FY 2025.

Presented by:

Bill Godshall, Chief Financial Officer

Updated: 9/5/2025 1:06 PM Page 1

STATE OF GEORGIA First Reading: September 8, 2025 COUNTY OF FULTON Second Reading: September 22, 2025

ORDINANCE TO ADOPT MILLAGE RATE

WHEREAS, the Mayor and Council of the City of Roswell are the governing authority of the City of Roswell; and

WHEREAS, the governing authority of the City of Roswell is authorized by State Law at O.C.G.A. § 32 to set the millage rate for the collection of ad valorem taxes; and

WHEREAS, all required notices have been published or are scheduled to be published in a newspaper of general circulation throughout the jurisdiction pursuant to such statute:

NOW, THEREFORE, the Mayor and Council of the City of Roswell wish to establish a millage rate of 4.949. The millage rate has a component of 4.049 mills for the general fund, operating and capital improvements budget, and a component of 0.900 mills for servicing bonded indebtedness.

The above Ordinance was read and approved by the Mayor and Council of the City of Roswell, Georgia on the 8 th day of September and the 22nd day of September, 2025.

Kurt M. Wilson, Mayor

Attest:

Nancy Saviano Long, City Clerk

(Seal)

City of Roswell

Mayor and Council

AGENDA ITEM REPORT

ID # - 10026

2

MEETING

DATE: September 8, 2025

DEPARTMENT: Economic Development

ITEM TYPE: Resolution

Approval of a Resolution for issuance of Downtown Development Authority (DDA) Revenue Bonds and Intergovernmental Contract between the City of Roswell and the DDA to finance the Hill Street parking deck.

Item Summary:

This is a Resolution to approve the Bond Resolution of the Downtown Development Authority authorizing the issuance of the Downtown Development Authority Georgia Taxable Revenue Bonds (Economic Development Project), Series 2025 in the aggregate principal amount not to exceed \$25,000,000 and to authorize the execution of an Intergovernmental Contract between the DDA and the City, to authorize the Mayor and other officers and officials of the city to take such further actions necessary to provide for the issuance and delivery of the revenue bonds.

Committee or Staff Recommendation:

N/A

Financial Impact:

City guarantees that the obligation is repaid by revenues.

Recommended Motion:

Motion to approve a Resolution for issuance of Downtown Development Authority Revenue Bonds and Intergovernmental Contract between the City of Roswell and the DDA to finance the Hill Street parking deck.

Presented by:

Joe Cusack, Assistant City Attorney

A RESOLUTION OF THE MAYOR AND COUNCIL OF THE CITY OF ROSWELL, GEORGIA (THE "CITY"), TO APPROVE THE BOND RESOLUTION OF THE DOWNTOWN DEVELOPMENT AUTHORITY OF THE CITY OF ROSWELL, GEORGIA AUTHORIZING THE ISSUANCE OF THE DOWNTOWN DEVELOPMENT AUTHORITY OF THE CITY OF ROSWELL, GEORGIA TAXABLE REVENUE BONDS (ECONOMIC DEVELOPMENT PROJECT), SERIES 2025, IN THE AGGREGATE PRINCIPAL AMOUNT OF NOT TO EXCEED \$25,000,000; TO AUTHORIZE THE EXECUTION OF AN INTERGOVERNMENTAL CONTRACT BETWEEN THE AUTHORITY AND THE CITY; TO AUTHORIZE THE MAYOR AND OTHER OFFICERS AND OFFICIALS OF THE CITY TO TAKE SUCH FURTHER ACTIONS AS ARE NECESSARY TO PROVIDE FOR THE ISSUANCE AND DELIVERY OF THE REVENUE BONDS DESCRIBED HEREIN; AND FOR OTHER PURPOSES.

WHEREAS, the Downtown Development Authority of the City of Roswell, Georgia (the "Authority") is a public body corporate and politic created and existing under the Downtown Development Authorities Law (O.C.G.A. § 1 et seq., as amended) (the "Act") for the purpose of providing for the revitalization and redevelopment of the central business district of the City of Roswell, Georgia (the "City") in order to develop and promote for the public good and general welfare trade, commerce, industry and employment opportunities; and

WHEREAS, under the Act and the Revenue Bond Law (O.C.G.A. § 60 et seq., as amended) (the "Revenue Bond Law"), the Authority has, among others, the power (a) to issue revenue bonds and use the proceeds for the purpose of paying all or part of the cost of any project (as authorized by the Act or the Revenue Bond Law), including projects that develop trade, commerce, industry and employment opportunities, and (b) to make and execute contracts and other instruments necessary to exercise the powers of the Authority; and

WHEREAS, under O.C.G.A. § 350, as amended, the City has, among others, the power to levy and collect an ad valorem property tax upon all taxable property within the limits of the City to provide financial assistance to the Authority, for the purpose of developing trade, commerce, industry, and employment opportunities, provided, however, that the tax levied for these purposes shall not exceed three mills per dollar upon the assessed value of such property; and

WHEREAS, Article IX, Section III, Paragraph I(a) of the Constitution of the State of Georgia authorizes, among other things, any county, municipality or other political subdivision of the State to contract, for a period not exceeding fifty years, with another county, municipality or political subdivision or with any other public agency, public corporation or public authority for joint services, for the provision of services, or for the provision or separate use of facilities or equipment, provided that such contract deals with activities, services or facilities which the contracting parties are authorized by law to undertake or to provide; and

WHEREAS, the City has requested that the Authority issue its Taxable Revenue Bonds (Economic Development Project), Series 2025, in the aggregate principal amount of not to exceed \$25,000,000 (the "Bonds") to provide funds to (i) finance, in whole or in part, the cost of acquiring, constructing and installing an economic development project, as more fully described in Exhibit A to the Contract (defined below) (the "Project"), (ii) pay capitalized interest on the Bonds and (iii) pay expenses necessary to accomplish the foregoing; and

WHEREAS, the Bonds shall be issued pursuant to a resolution of the Authority, adopted on September 2, 2025 (the "Bond Resolution"), a form of which is attached hereto as Exhibit A; and

WHEREAS, the exact aggregate principal amount of the Bonds and interest rates thereon will be determined by the Authority in a resolution supplementing the Bond Resolution (the "Supplemental Bond Resolution"); and

WHEREAS, the Authority and the City propose to enter into an Intergovernmental Contract, dated as of the date thereof (the "Contract"), pursuant to which the Authority will agree to issue the Series 2025 Bonds to acquire, construct and install the Project, and to provide economic development facilities and services for the citizens of the City, and the City, in consideration of the Authority's doing so, will agree to pay to the Authority amounts sufficient to pay the principal of, premium, if any, and interest on the Series 2025 Bonds and to levy an ad valorem property tax (if necessary), on the assessed value of all property located within the City subject to such tax, at such rate or rates, limited to three mills per dollar (or such greater amount as may hereafter be authorized by applicable law), in order to pay the principal of, premium, if any, and interest on the Series 2025 Bonds (the "Pledged Payments"); and

WHEREAS, the Bonds will be secured by a first lien on the Contract and the Pledged Payments; and

WHEREAS, the City proposes to authorize the use and distribution of a Preliminary Official Statement relating to the Bonds (the "Preliminary Official Statement"), authorize the execution, delivery and use of an Official Statement relating to the Bonds (the "Official Statement") and "deem final" the Preliminary Official Statement for purposes of Rule 15c12 promulgated by the Securities and Exchange Commission; and

WHEREAS, the City proposes to authorize the execution, delivery and performance of a Continuing Disclosure Certificate (the "Disclosure Certificate") to assist the initial purchaser of the Bonds in complying with its obligations under Rule 15c12 of the Securities Exchange Act of 1934, as amended; and

WHEREAS, it is necessary and proper that the Mayor and Council of the City approve the form of the Bond Resolution and the Contract, and authorize the Mayor to execute the Contract and the Disclosure Certificate.

NOW, THEREFORE, BE IT RESOLVED by the Mayor and Council of the City as follows:

The City has made a finding of fact that:

1) The Projects are "projects" and/or "undertakings" as defined pursuant to the Act or the Revenue Bond Law and is "self-liquidating" as defined pursuant to the Act; and

2) Following study and investigation, the City has determined that it is in the best interests to enter into the Contract with the Authority in connection with the Projects for the benefit of the City and its citizens;

BE IF FURTHER RESOLVED, as follows:

1. The Mayor and Council of the City hereby approve the form of the Bond Resolution, adopted by the Authority on September 2, 2025, in substantially the form attached hereto as Exhibit A, together with such supplements and amendments which may be made thereto with the consent of the Mayor of the City (the "Mayor").

2. The Mayor is authorized and directed to cause to be prepared an answer to be filed in validation proceedings requesting that the Bonds and the security therefor be declared valid in all respects.

3. Subject to Section 9 below, the execution, delivery and performance by the City of the Contract, in substantially the form attached hereto as Exhibit B, between the City and the Authority be and the same are hereby authorized. The Mayor is authorized to agree to any amendments to the Contract as may be necessary prior to the issuance of each series of the Bonds, and the execution and delivery of any such amendments shall be conclusive evidence of such approval. The Clerk of the City is authorized to attest the execution by the Mayor of the Contract and to affix the seal of the City to such documents.

4. Subject to Section 9 below, the execution, delivery and performance of the Disclosure Certificate are hereby authorized. The Disclosure Certificate shall be in substantially the forms presented for approval at the meeting of the Mayor and Council of the City to adopt the Supplemental Resolution.

5. Prior to the execution of the Contract, and any amendments thereto, the Disclosure Certificate or other documents, the Mayor may approve any exhibits thereto and such other changes or additions as may be necessary and desirable to effect the purposes of this resolution, and the execution of the Contract, the Disclosure Certificate or other documents by the Mayor shall be conclusive evidence of such approval.

6. The use and distribution of the Preliminary Official Statement are hereby ratified and approved. Subject to Section 9 below, the use, distribution and execution of the Official Statement are hereby authorized, provided that such Official Statement is in substantially the same form as the Preliminary Official Statement. The execution of the Official Statement by the Mayor, as hereby authorized shall be conclusive evidence of the approval of any such changes.

7. The execution and delivery of a certificate deeming the Preliminary Official Statement final for purpose of Rule 15c12 promulgated under the Securities and Exchange Act of 1934, as amended, are hereby authorized and approved.

8. The Mayor, Clerk of the City, and such other officials as may be required are directed to take such actions and to complete such transfers as are necessary to provide security for payment of the Bonds in accordance with the Bond Resolution and any amendments or supplemental resolutions of the Authority and to fulfill the obligations of the City pursuant to the Contract, as the same may be hereafter amended, and to take such other actions as may be required in accordance with the intents and purposes of this resolution.

9. The Contract, and any amendment thereto, the Disclosure Certificate and the Official Statement shall not be executed until the Mayor and Council of the City have been provided a certified copy of the Supplemental Bond Resolution and have adopted a supplemental resolution, approving such Supplemental Bond Resolution and the final terms for the Bonds.

10. The Mayor is hereby authorized to execute and deliver a certification, based upon facts, estimates and circumstances, as to reasonable expectations regarding the amount, expenditure and use of the proceeds of the Bonds, as well as such other documents as may be necessary or desirable in connection with the issuance and delivery of the Bonds.

11. No stipulation, obligation or agreement herein contained or contained in the Contract shall be deemed to be a stipulation, obligation or agreement of the Mayor or Clerk of the City in their individual capacity, and neither the Mayor nor the Clerk of the City shall be personally liable under the Contract or on the Bonds or be subject to personal liability or accountability by reason of the issuance thereof.

12. From and after the execution and delivery of the Contract, and any amendments thereto and the Disclosure Certificate, the Mayor is hereby authorized, empowered, and directed to perform all actions and things, relating to the Contract and the issuance of the Bonds, and to execute all such documents as may be necessary to carry out and comply with the provisions of said Contract, and any amendments thereto, as executed, and is further authorized to take any and all further actions and execute and deliver any and all other documents and certificates as may be necessary or desirable in connection with the issuance of the Bonds and the execution and delivery of the Contract. The Clerk of City is authorized, empowered, and directed to attest the signatures of the Mayor, as and if necessary, with the signatures of such persons to be conclusive evidence of their authority to do and perform such actions and things.

13. All acts and doings of the Mayor which are in conformity with the purposes and intents of this Resolution and in the furtherance of the issuance of the Bonds and the execution, delivery and performance of the Contract, and any amendments thereto, and the Disclosure Certificate shall be, and the same hereby are, in all respects approved and confirmed.

14. If any one or more of the agreements or provisions herein contained shall be held contrary to any express provision of law or contrary to the policy of express law, though not expressly prohibited, or against public policy, or shall for any reason whatsoever be held invalid, then such covenants, agreements or provisions shall be null and void and shall be deemed

separable from the remaining agreements and provisions and shall in no way affect the validity of any of the other agreements and provisions hereof.

15. All ordinances, resolutions or parts thereof of the City in conflict with the provisions herein contained are, to the extent of such conflict, hereby superseded and repealed.

16. This Resolution shall take effect immediately upon its adoption.

CITY OF ROSWELL, GEORGIA

By: \\\\\\\\\\\\\\\ Mayor

(S E A L)

Attest: \\\\\\\\\\\\\_

Clerk

Exhibit A

Bond Resolution

2.a

Exhibit B

Contract Agreement

CLERK'S CERTIFICATE

The undersigned does hereby certify that the foregoing pages of typewritten matter constitute a true and correct copy of a resolution pertaining to the City of Roswell, Georgia (the "City"), which resolution was duly adopted at a meeting of the Mayor and Council of the City duly called and assembled on September \\, 2025, and at which a quorum was present and acting throughout and that the original of said resolution appears of record in the minute book of the Mayor and Council of the City which is in my custody and control, and that said resolution has not been amended, repealed, revoked or rescinded as of the date hereof.

Given under my hand and the seal of the City this \\ day of September, 2025.

(S E A L) \\\\\\\\\\\\\\\\_

Clerk

BOND RESOLUTION

RESOLUTION OF THE DOWNTOWN DEVELOPMENT AUTHORITY OF THE CITY OF ROSWELL, GEORGIA PROVIDING FOR THE ISSUANCE OF ITS TAXABLE REVENUE BONDS (ECONOMIC DEVELOPMENT PROJECT), SERIES 2025 IN THE AGGREGATE PRINCIPAL AMOUNT NOT TO EXCEED \$25,000,000, IN ORDER TO FINANCE THE COST OF ACQUIRING, CONSTRUCTING AND INSTALLING A CERTAIN ECONOMIC DEVELOPMENT PROJECT IN THE CITY OF ROSWELL, GEORGIA; TO PROVIDE FOR THE ISSUANCE UNDER CERTAIN TERMS AND CONDITIONS OF ADDITIONAL PARITY BONDS; TO PROVIDE FOR THE CREATION OF CERTAIN FUNDS; TO PROVIDE FOR THE CREATION OF REMEDIES OF THE HOLDERS OF THE SERIES 2025 BONDS ISSUED HEREUNDER; TO AUTHORIZE THE EXECUTION OF A CONTRACT WITH CITY OF ROSWELL, GEORGIA; AND FOR OTHER RELATED PURPOSES.

TABLE OF CONTENTS

ARTICLE I.

DEFINITIONS AND FINDINGS4

Section 1.1.

Section 1.2. Definitions of Certain Terms.

4

Findings9

ARTICLE II.

AUTHORIZATION AND TERMS OF BONDS; FORM AND REGISTRATION

OF BONDS

10

Section 2.1.

Section 2.2.

Section 2.3.

Section 2.4.

Section 2.5.

Section 2.6.

Section 2.7.

Section 2.8.

Section 2.9.

Section 2.10.

Section 2.11.

Section 2.12. Authorization of Series 2025 Bonds10

Terms of Series 2025 Bonds10

Execution of Bonds11

Authentication of Bonds.

11

Medium and Places of Payment11

Registration of Transfer and Exchange of Bonds12

Mutilated, Destroyed or Lost Bonds13

Limited Obligations.

13

Blank Bonds; Cancellation After Exchange.

13

Additional Bonds.

14

Global Form; Securities Depository; Ownership of Series 2025

Bonds.

14

Form of Bonds.

15

ARTICLE III.

REDEMPTION OF BONDS BEFORE MATURITY16

Section 3.1.

Section 3.2.

Section 3.3.

Section 3.4.

Section 3.5.

Section 3.6. Redemption16

Optional and Mandatory Redemption16

Partial Redemption of Bonds16

Revised Schedule of Pledged Payments.

17

Redemption Account.

17

Notice of Redemption; Deposit of Moneys; Written Designation17

ARTICLE IV.

CUSTODY AND APPLICATION OF PROCEEDS; PROJECT FUND19

Section 4.1.

Section 4.2.

Section 4.3.

Section 4.4.

Section 4.5. Application of Bond Proceeds.

19

Project Fund19

Availability of Requisitions and Certificates20

After Acquisition, Construction and Installation of Project.

20

Transfer Upon Event of Default of Final Bond Payment

20

ARTICLE V. PLEDGED PAYMENTS AND FUNDS

21

Section 5.1.

Section 5.2.

Section 5.3.

Section 5.4.

Section 5.5. Pledge of Contract and Contract Payments; Creation of Sinking

Fund.

21

Sinking Fund as a Trust Fund; Investment of Moneys21

Sinking Fund Disbursements.

21

Cancellation and Destruction22

Defeasance.

22

ARTICLE VI.

DEPOSITORIES AND CUSTODIANS; SECURITIES FOR DEPOSITS23

Section 6.1. Depository; Security for Deposits23

Section 6.2.

Designation of Depository and Custodians23

ARTICLE VII.

PARTICULAR COVENANTS

24

Section 7.1.

Payment24

Section 7.2.

Liens24

Section 7.3.

Records and Accounts24

Section 7.4.

Future Debt.

24

ARTICLE VIII.

EVENTS OF DEFAULT; REMEDIES

25

Section 8.1.

Events of Default.

25

Section 8.2.

Remedies25

Section 8.3.

Restoration.

26

Section 8.4.

Equal Benefit.

26

Section 8.5.

Nonexclusivity of Remedies26

Section 8.6.

No Waiver26

Section 8.7.

Notice of Defaults; Opportunity of the Authority and City to Cure

Defaults26

ARTICLE IX.

SUPPLEMENTAL PROCEEDINGS

28

Section 9.1.

Adoption of Supplemental Proceedings28

Section 9.2.

Notice28

Section 9.3.

Required Approval29

Section 9.4.

Legal Action29

Section 9.5.

Incorporation29

Section 9.6.

Proof of Ownership29

ARTICLE X.

MISCELLANEOUS PROVISIONS

30

Section 10.1.

Severability.

30

Section 10.2.

Contract30

Section 10.3.

Administrative Fees and Expenses

30

Section 10.4.

Offering Documents; Deemed Final Certificate and Continuing

Disclosure Certificate31

Section 10.5.

The Pledge of Payments and Assignment of Contract31

Section 10.6.

General Authority.

32

Section 10.7.

Bond Resolution as Contract.

32

Section 10.8.

Validation33

Section 10.9.

Repealer.

33

Section 10.10.Notice of Sale of Series 2025 Bonds.

33

Section 10.11.No Performance Audits or Reviews.

33

Section 10.12.Notices.

33

- Exhibit A Form of Series 2025 Bonds

- Exhibit B Form of Requisition

- Exhibit C Form of Contract

Packet Pg. 32

BOND RESOLUTION

RESOLUTION OF THE DOWNTOWN DEVELOPMENT AUTHORITY OF THE CITY OF ROSWELL, GEORGIA PROVIDING FOR THE ISSUANCE OF ITS TAXABLE REVENUE BONDS (ECONOMIC DEVELOPMENT PROJECT), SERIES 2025 IN THE AGGREGATE PRINCIPAL AMOUNT NOT TO EXCEED \$25,000,000, IN ORDER TO FINANCE THE COST OF ACQUIRING, CONSTRUCTING AND INSTALLING A CERTAIN ECONOMIC DEVELOPMENT PROJECT IN THE CITY OF ROSWELL, GEORGIA; TO PROVIDE FOR THE ISSUANCE UNDER CERTAIN TERMS AND CONDITIONS OF ADDITIONAL PARITY BONDS; TO PROVIDE FOR THE CREATION OF CERTAIN FUNDS; TO PROVIDE FOR THE CREATION OF REMEDIES OF THE HOLDERS OF THE SERIES 2025 BONDS ISSUED HEREUNDER; TO AUTHORIZE THE EXECUTION OF A CONTRACT WITH CITY OF ROSWELL, GEORGIA; AND FOR OTHER RELATED PURPOSES

WHEREAS, the Downtown Development Authority of the City of Roswell, Georgia (the "Authority") is a public body corporate and politic created and existing under the Downtown Development Authorities Law (O.C.G.A. § 1 et seq., as amended) (the "Act") for the purpose of providing for the revitalization and redevelopment of the central business district of the City of Roswell, Georgia (the "City") in order to develop and promote for the public good and general welfare trade, commerce, industry and employment opportunities; and

WHEREAS, under the Act and the Revenue Bond Law (O.C.G.A. § 60 et seq., as amended) (the "Revenue Bond Law"), the Authority has, among others, the power (a) to issue revenue bonds and use the proceeds for the purpose of paying all or part of the cost of any project (as authorized by the Act or the Revenue Bond Law), including projects that develop trade, commerce, industry and employment opportunities, and (b) to make and execute contracts and other instruments necessary to exercise the powers of the Authority; and

WHEREAS, under O.C.G.A. § 350, as amended, the City has, among others, the power to levy and collect an ad valorem property tax upon all taxable property within the limits of the City to provide financial assistance to the Authority, for the purpose of developing trade, commerce, industry, and employment opportunities, provided, however, that the tax levied for these purposes shall not exceed three mills per dollar upon the assessed value of such property; and

WHEREAS, Article IX, Section III, Paragraph I(a) of the Constitution of the State of Georgia authorizes, among other things, any county, municipality or other political subdivision of the State to contract, for a period not exceeding fifty years, with another county, municipality or political subdivision or with any other public agency, public corporation or public authority for joint services, for the provision of services, or for the provision or separate

2.b

WHEREAS, the Act provides that the Authority may contract with political subdivisions and municipal corporations of the State of Georgia; and

WHEREAS, the City is a municipal corporation of the State of Georgia, legally created and validly existing under the laws of the State of Georgia; and

WHEREAS, the City and the Authority are governmental bodies as described in the Revenue Bond Law, and are authorized to undertake projects described therein which include the acquisition, construction and installation thereon of facilities for lease to industries, so as to relieve abnormal unemployment conditions; and

WHEREAS, the Authority and the City propose to acquire, construct and install an economic development project located in the City, as more fully described in Exhibit A to the Contract (as defined below) (the "Project"); and

WHEREAS, the Authority proposes to issue its Taxable Revenue Bonds (Economic Development Project), Series 2025 in the aggregate principal amount not to exceed \$25,000,000 (the "Series 2025 Bonds") for the purpose of providing funds to finance, in whole or in part, the cost of (i) acquiring, constructing and installing the Project, (ii) paying capitalized interest on the Series 2025 Bonds, and (iii) issuing the Series 2025 Bonds; and

WHEREAS, the Authority and the City propose to enter into an Intergovernmental Contract, dated as of the date thereof (the "Contract"), pursuant to which the Authority will agree to issue the Series 2025 Bonds to acquire, construct and install the Project and to provide economic development facilities and services for the citizens of the City, and the City, in consideration of the Authority's doing so, will agree to pay to the Authority amounts sufficient to pay the principal of, premium, if any, and interest on the Series 2025 Bonds and to levy an ad valorem property tax (if necessary), on the assessed value of all property located within the City subject to such tax, at such rate or rates, limited to three mills per dollar as prescribed by O.C.G.A. § 350, as amended (or such greater amount as may hereafter be authorized by applicable law), in order to pay the principal of, premium, if any, and interest on the Series 2025 Bonds (the "Pledged Payments"); and

WHEREAS, the Series 2025 Bonds will be secured by a first lien on the Contract Agreement and the Pledged Payments; and

WHEREAS, the Authority proposes to authorize the use and distribution of a Preliminary Official Statement relating to the Series 2025 Bonds (the "Preliminary Official Statement"), authorize the execution, delivery and use of an Official Statement relating to the Series 2025 Bonds (the "Official Statement") and "deem final" the Preliminary Official Statement for purposes of Rule 15c12 promulgated by the Securities and Exchange Commission; and

WHEREAS, the Authority has retained the services of First Tryon Advisors, LLC, to act as municipal advisor for the Series 2025 Bonds (the "Municipal advisor"); and

WHEREAS, the Municipal advisor has advised that it is in the best interest of the Authority to prepare a notice of sale to be submitted to prospective underwriters and purchasers of the Series 2025 Bonds and to receive competitive bids; and

WHEREAS, the Authority and the City desire to authorize and direct (i) the Municipal advisor to prepare and publish the appropriate notices of sale for the Series 2025 Bonds and to have the Chief Financial Officer of the City review all bids received in accordance with such notices; and (ii) the Chief Financial Officer of the City to award the sale of the Series 2025 Bonds to the bidder(s) submitting the best bid(s) with the lowest true interest cost to the Authority and the City; and

WHEREAS, the Authority has made a finding of fact that (a) the Project is an economic development project in furtherance of the Authority's purpose and mission under the Act, and (b) the issuance of the Series 2025 Bonds to finance the Project will increase employment in the City; and

WHEREAS, the City has certified that based on the City's 2024 bond tax digest, three mills per dollar on the assessed value of all taxable property in the City is a sufficient amount to pay the amounts provided in the Contract.

NOW, THEREFORE, BE IT RESOLVED, by the Downtown Development Authority of the City of Roswell, Georgia, and it is hereby resolved by authority of same, as follows:

2.b

ARTICLE I.

DEFINITIONS AND FINDINGS

Section 1.1. Definitions of Certain Terms.

In addition to the terms hereinabove defined, whenever the following terms are used in this Bond Resolution, the same, unless the context shall clearly indicate another or different meaning or intent, shall be construed or used and are intended to have the meaning set forth in the Contract or set forth below:

"Act" means the Downtown Development Authorities Law (O.C.G.A. § 1 et seq.), as thereafter amended.

"Agent Member" means a member of, or participant in, the Securities Depository.

"Authenticating Agent" means initially U.S. Bank Trust Company, National Association, Atlanta, Georgia, its successors and assigns, or any successor authenticating agent hereafter appointed by the Authority and approved by the City; provided, however, the Authenticating Agent shall at all times be a commercial bank or trust company.

"Authority" means the Downtown Development Authority of the City of Roswell, Georgia, a body corporate and politic, created pursuant to the Act.

"Beneficial Owner" shall mean the owners of a beneficial interest in the Series 2025 Bonds registered in Book-Entry-Form.

"Bond Registrar" means initially U.S. Bank Trust Company, National Association, Atlanta, Georgia, its successors and assigns, or any successor bond registrar hereafter appointed by the Authority and approved by the City; provided, however, the Bond Registrar shall at all times be a commercial bank or trust company.

"Bond Resolution" means this Bond Resolution, and as same may be supplemented from time to time.

"Bondholder" and "owner" means the registered owner of any of the outstanding Bonds.

"Book-Entry-Form" or "Book-Entry-System" shall mean, with respect to the Series 2025 Bonds, a form or system, as applicable, under which (i) the ownership of beneficial interests in the Series 2025 Bonds and bond service charges may be transferred only through book entry and (ii) physical Series 2025 Bonds in fully registered form are registered only in the name of a Securities Depository or its nominee as holder, with physical Series 2025 Bonds in the custody of a Securities Depository.

"City" means City of Roswell, Georgia.

"Contract" means the Intergovernmental Contract, dated as of the date thereof, between the Authority and the City, with respect to the Series 2025 Bonds, as the same from time to time may be amended.

"Contract Payments" means the payments which are to be received by the Authority pursuant to Section 4.2 of the Contract, which are equal to the amounts sufficient to enable the Authority to pay the principal of, premium, if any, and interest on the Series 2025 Bonds as the same become due, whether at maturity or by proceedings for mandatory redemption; provided, however, the City shall receive a credit against any required Contract Payment to the extent moneys are on deposit in the Sinking Fund and available to pay the principal of, premium, if any, and interest on the Series 2025 Bonds coming due on the next succeeding June 1 or December 1, or such other dates as may be determined by the Authority in a supplemental resolution to be adopted prior to the delivery of the Series 2025 Bonds, as the case may be. In addition to the foregoing, each Contract Payment shall include the charges as billed specified in subparagraphs (e) and (f) of Section 3, Article V of this Bond Resolution and any deficit in any preceding Contract Payment.

"Fiscal Year" means the period commencing on the 1st day of January in each calendar year and extending through the 31st day of December of that year.

"Government Obligations" means (a) direct obligations of the United States of America for the full and timely payment of which the full faith and credit of the United States of America is pledged, or (b) obligations issued by a person controlled or supervised by and acting as an instrumentality of the United States of America, the full and timely payment of the principal of, premium, if any, and the interest on which is fully and unconditionally guaranteed as a full faith and credit obligation of the United States of America (including any securities described in (a) or (b) issued or held in book-entry form on the books of the Department of the Treasury of the United States of America), which obligations, in either case, are not subject to redemption prior to maturity at less than par by anyone other than the holder.

"Interest Payment Date" means the 1st day of each June and December of each year, commencing June 1, 2026 or such other dates as may be determined by the Authority in a supplemental resolution to be adopted prior to the delivery of the Series 2025 Bonds.

"Paying Agent" means initially U.S. Bank Trust Company, National Association, Atlanta, Georgia, its successors and assigns, or any successor paying agent hereafter appointed by the Authority and approved by the City; provided, however, the Paying Agent shall at all times be a commercial bank or trust company.

"Permitted Investments" means and includes any of the following securities, if and to the extent the same are at the time legal for investment of Authority funds:

(1) the local government investment pool created in Chapter 83 of Title 36 of the Official Code of Georgia Annotated, as amended;

(2) Bonds or obligations of such county, municipal corporation, school district, political subdivision, authority, or body or bonds or obligations of the State of Georgia or other states or of other counties, municipal corporations, and political subdivisions of the State of Georgia;

(3) Bonds or other obligations of the United States or of subsidiary corporations of the United States government which are fully guaranteed by such government;

(4) Obligations of and obligations guaranteed by agencies or instrumentalities of the United States government, including those issued by the Federal Land Bank, Federal Home Loan Bank, Federal Intermediate Credit Bank, Bank for Cooperatives, and any other such agency or instrumentality now or hereafter in existence; provided, however, that all such obligations shall have a current credit rating from a nationally recognized rating service of at least one of the three highest rating categories available and have a nationally recognized market;

(5) Bonds or other obligations issued by any public housing agency or municipal corporation in the United States, which such bonds or obligations are fully secured as to the payment of both principal and interest by a pledge of annual contributions under an annual contributions contract or contracts with the United States government, or project notes issued by any public housing agency, urban renewal agency, or municipal corporation in the United States which are fully secured as to payment of both principal and interest by a requisition, loan, or payment agreement with the United States government;

(6) Certificates of deposit of national or state banks located within the State of Georgia which have deposits insured by the Federal Deposit Insurance Corporation and certificates of deposit of federal savings and loan associations and state building and loan or savings and loan associations located within the State of Georgia which have deposits insured by the Savings Association Insurance Fund of the Federal Deposit Insurance Corporation or the Georgia Credit Union Deposit Insurance Corporation, including the certificates of deposit of any bank, savings and loan association, or building and loan association acting as depository, custodian, or trustee for any such bond proceeds. The portion of such certificates of deposit in excess of the amount insured by the Federal Deposit Insurance Corporation, the Savings Association Insurance Fund of the Federal Deposit Insurance Corporation, or the Georgia Credit Union Deposit Insurance Corporation, if any, shall be secured by deposit, with the Federal Reserve Bank of Atlanta, Georgia, or with any national or state bank or federal savings and loan association or state building and loan or savings and loan association located within the State of Georgia or with a trust office within the State of Georgia, of one or more of the following securities in an aggregate principal amount equal at least to the amount of such excess: direct and general obligations of the State of Georgia or other states or of any county or municipal corporation in the State of Georgia, obligations of the United States or subsidiary corporations described in (3) above, obligations of the agencies and instrumentalities of the United States government described in (4) above, or bonds,

obligations, or project notes of public housing agencies, urban renewal agencies, or municipalities described in (5) above;

(7) Securities of or other interests in any no-load, open-end management type investment company or investment trust registered under the Investment Company Act of 1940, as from time to time amended, or any common trust fund maintained by any bank or trust company which holds such proceeds as trustee or by an affiliate thereof so long as:

(A) The portfolio of such investment company or investment trust or common trust fund is limited to the obligations referenced in paragraphs (3) and (4) above and repurchase agreements fully collateralized by any such obligations;

(B) Such investment company or investment trust or common trust fund takes delivery of such collateral either directly or through an authorized custodian;

(C) Such investment company or investment trust or common trust fund is managed so as to maintain its shares at a constant net asset value; and

(D) Securities of or other interests in such investment company or investment trust or common trust fund are purchased and redeemed only through the use of national or state banks having corporate trust powers and located within the State of Georgia; and

(8) Interest-bearing time deposits, repurchase agreements, reverse repurchase agreements, rate guarantee agreements, or other similar banking arrangements with a bank or trust company having capital and surplus aggregating at least \$50 million or with any government bond dealer reporting to, trading with, and recognized as a primary dealer by the Federal Reserve Bank of New York having capital aggregating at least \$50 million or with any corporation which is subject to registration with the Board of Governors of the Federal Reserve System pursuant to the requirements of the Bank Holding Company Act of 1956, provided that each such interest-bearing time deposit, repurchase agreement, reverse repurchase agreement, rate guarantee agreement, or other similar banking arrangement shall permit the moneys so placed to be available for use at the time provided with respect to the investment or reinvestment of such moneys.

(9) any other investments authorized by the laws of the State of Georgia.

"Pledged Payments" means the Contract Payments which are to be received by the Authority pursuant to Section 4.2(a) of the Contract which shall be equal to the amounts sufficient to enable the Authority to pay the principal of, premium, if any, and interest on the Series 2025 Bonds as the same become due, whether at maturity or by proceedings for mandatory redemption.

"Project" the economic development Project financed with the proceeds of the Series 2025 Bonds described more fully in Exhibit A to the Contract.

"Project Fund" means the Downtown Development Authority of the City of Roswell, Georgia Project Fund created in Article IV, Section 2 of this Bond Resolution.

"Project Fund Depository" means JPMorgan Chase Bank, N.A., Atlanta, Georgia, its successors and assigns, or any successor project fund custodian hereafter appointed by the Authority and approved by the City; provided, however, the Project Fund Depository shall at all times be a commercial bank or trust company.

"Securities Depository" means any securities depository that is a "clearing corporation" within the meaning of the New York Uniform Commercial Code and a "clearing agency" registered pursuant to provisions of Section 17A of the Securities Exchange Act of 1934, operating and maintaining, with its participants or otherwise, a Book-Entry-System to record ownership of beneficial interest in bonds and bond service charges, and to effect transfers of bonds in Book-Entry-Form, and means, initially, The Depository Trust Company (a limited purpose trust company), New York, New York.

"Securities Depository Nominee" means any nominee of a Securities Depository and shall initially mean Cede and Co., New York, New York, as nominee of The Depository Trust Company.

"Series 2025 Bonds" means the not to exceed \$25,000,000 in aggregate principal amount of Downtown Development Authority of the City of Roswell, Georgia Taxable Revenue Bonds (Economic Development Project), Series 2025 authorized to be issued pursuant to Article II of this Bond Resolution.

"Sinking Fund" shall mean the Downtown Development Authority of the City of Roswell, Georgia Sinking Fund created in Article V, Section 1 of this Bond Resolution.

"Sinking Fund Custodian" means initially U.S. Bank Trust Company, National Association, Atlanta, Georgia, its successors and assigns, or any successor sinking fund custodian hereafter appointed by the Authority with the approval of the City; provided, however, the Sinking Fund Custodian shall at all times be a commercial bank or trust company.

"Sinking Fund Investments" shall mean (a) obligations of the United States and its agencies and instrumentalities, (b) certificates of deposit of banks which have deposits insured by the Federal Deposit Insurance Corporation, provided, however, that the portion of such certificates of deposit in excess of the amount insured by the Federal Deposit Insurance Corporation must be secured by direct obligations of the State of Georgia or the United States which are of a par value equal to that portion of such certificates of deposit which would be uninsured, and (c) the local government investment pool established by Section 8 of the Official Code of Georgia Annotated.

"Sinking Fund Year" shall mean the period commencing on the 2nd day of December in each year and extending through the 1st day of December in the next year or such other dates as may be determined by the Authority in a supplemental resolution to be adopted prior to the delivery of the Series 2025 Bonds.

"Unassigned Rights" means the Contract Payments which are to be received by the Authority pursuant to Section 4.2(b) of the Contract which do not constitute Pledged Payments.

Whenever used in this Bond Resolution, the singular shall include the plural and the plural shall include the singular, unless the context otherwise indicates.

Section 1.2. Findings

In connection with the financing of the Project, the members of the Authority hereby make the following findings and determinations:

(a) the issuance of the Series 2025 Bonds is hereby found and declared to be within the public purposes intended to be served by the Authority; and

(b) the Project is an economic development project in furtherance of the Authority's purpose and mission and constitutes a project which may be undertaken by the Authority pursuant to the Act; and

(c) the issuance of the Series 2025 Bonds to finance the Project will increase employment in the City; and

(d) the execution and delivery of the Contract are authorized under the Act and by entering into the Contract, the Authority will be furthering the public purposes for which it was created.

ARTICLE II.

AUTHORIZATION AND TERMS OF BONDS; FORM AND REGISTRATION OF BONDS

Section 2.1. Authorization of Series 2025 Bonds.

There is hereby authorized to be issued the Series 2025 Bonds designated as the "Downtown Development Authority of the City of Roswell, Georgia Taxable Revenue Bonds (Economic Development Project), Series 2025" in the aggregate principal amount not to exceed \$25,000,000 for the purpose of providing funds to finance, in whole or in part, the cost of (i) acquiring, constructing and installing the Project, (ii) paying capitalized interest on the Series 2025 Bonds, and (iii) issuing the Series 2025 Bonds. The Series 2025 Bonds shall be payable solely from the Pledged Payments. All of the covenants, agreements and provisions of this Bond Resolution shall be for the equal and proportionate benefit and security of all owners of the Series 2025 Bonds issued hereunder.

Section 2.2. Terms of Series 2025 Bonds

The Series 2025 Bonds shall be dated as of their date of issuance and delivery, shall be in the form of fully registered bonds without coupons, shall be in the denomination of \$5,000 or any integral multiple thereof, shall be transferable to subsequent owners as hereinafter provided, shall be numbered R-1 upward, shall bear interest (based on a day year comprised of twelve thirty-day months) from the Interest Payment Date (hereinafter defined) next preceding their date of authentication to which interest has been paid (unless their date of authentication is an Interest Payment Date, in which case from such Interest Payment Date, unless their date of authentication is after a record date but before an Interest Payment date, in which case from the next Interest Payment Date, or unless their date of authentication is before the first Interest Payment Date, in which case from the date of issuance) at rates set forth below. The interest shall be payable on June 1, 2026 and semiannually thereafter on the 1st days of June and December in each year or such other dates as may be determined by the Authority in a supplemental resolution to be adopted prior to the delivery of the Series 2025 Bonds (each such date an "Interest Payment Date"), and the principal shall mature on the 1st day of December or such other dates as may be determined by the Authority in a supplemental resolution to be adopted prior to the delivery of the Series 2025 Bonds .

The Series 2025 Bonds shall be issued in a principal amount not to exceed \$25,000,000; shall bear interest at a true interest cost not to exceed 7.5% per annum; shall have a final maturity not later than December 1, 2056; and shall have maximum annual debt service in any sinking fund year not to exceed \$7,500,000. The principal amount in each year (through the operation of a sinking fund or otherwise), the interest rate on each such maturity, and the mandatory sinking fund redemption provisions shall be specified by the Authority in a supplemental resolution.

The principal amount of the Series 2025 Bonds shall be payable at maturity, unless redeemed prior thereto as hereinafter provided, upon presentation and surrender thereof at the principal corporate trust office of the Paying Agent. Interest on the Series 2025 Bonds shall be

2.b

paid on each Interest Payment Date by check or draft mailed by first class mail as provided in Section 2.5 below, except that in the case of any owner of Series 2025 Bonds in an aggregate principal amount of at least \$1,000,000 who, on or prior to any Record Date, shall supply wire transfer instructions to the Paying Agent, interest due on the Interest Payment Date next succeeding such Record Date shall be payable by wire transfer in accordance with such instructions.

Section 2.3. Execution of Bonds.

The Series 2025 Bonds shall be executed in the name of the Authority by the manual or facsimile signature of the Chairman of the Authority and the official seal of the Authority shall be printed or impressed thereon and attested by the manual or facsimile signature of the Secretary of the Authority. In case any officer who shall have signed or sealed any of the Series 2025 Bonds shall cease to be such officer before the Series 2025 Bonds so signed and sealed have been actually authenticated and delivered, such Series 2025 Bonds shall nevertheless be authenticated and delivered as herein provided and may be issued as though the person who signed or sealed such Series 2025 Bonds had not ceased to be such officer. Any Series 2025 Bonds may be signed and sealed on behalf of the Authority by such persons as shall be the proper officers of the Authority at the actual time of the execution of such Series 2025 Bonds, even if such persons may not have been officers of the Authority at the date of issuance of such Series 2025 Bonds.

Section 2.4. Authentication of Bonds.

Only such Series 2025 Bonds as shall have endorsed thereon a certificate of authentication substantially in the form hereinafter set forth executed by an officer or employee of the Authenticating Agent shall be entitled to any right or benefit hereunder. No Series 2025 Bond shall be valid or obligatory for any purpose unless and until such certificate of authentication shall have been so executed by the Authenticating Agent, and such executed certificate of the Authenticating Agent upon any such Series 2025 Bond shall be conclusive evidence that such Series 2025 Bond has been authenticated and delivered hereunder. Said certificate of authentication on any Series 2025 Bond shall be deemed to have been executed by the Authenticating Agent if signed by an authorized officer or employee of the Authenticating Agent, but it shall not be necessary that the same officer or employee sign the certificate of authentication on all of the Series 2025 Bonds issued hereunder.

Section 2.5. Medium and Places of Payment.

The principal, interest and redemption premium (if any) on the Series 2025 Bonds shall be payable in any coin or currency of the United States of America, which at the time of payment is legal tender for the payment of public and private debts. The principal and redemption premium (if any) of the Series 2025 Bonds shall be payable only upon the presentation and surrender of the Series 2025 Bonds at the principal corporate trust office of U.S. Bank Trust Company, National Association, Atlanta, Georgia, as Paying Agent for the Series 2025 Bonds. Interest on the Series 2025 Bonds shall be paid by check or draft mailed by first class mail on the date on which due by the Paying Agent to the respective owners of the Series 2025 Bonds at their addresses as they appear on the Record Date relating to such Interest Payment Date on the

bond register kept by the Bond Registrar, except as provided in Section 2.2 above with respect to the Series 2025 Bonds. The Authority may, by supplemental resolution, provide for other methods or places of payment, including wire transfer, as it may deem appropriate in connection with the issuance of any Additional Parity Bonds.

Notwithstanding the foregoing, the Series 2025 Bonds shall be issued in Book-Entry Form and registered in the name of the Securities Depository or the Security Depository Nominee as provided in Section 2.11 below. All Series 2025 Bonds may have endorsed thereon such legends, text or identification numbers as may be necessary or appropriate to conform to any applicable rules and regulations of any governmental authority or of any securities exchange on which the Series 2025 Bonds may be listed or any usage or requirement of law with respect thereto.

Section 2.6. Registration of Transfer and Exchange of Bonds.

The Bond Registrar of the Authority shall maintain a register for registration of transfer of the Series 2025 Bonds. U.S. Bank Trust Company, National Association, Atlanta, Georgia, is hereby designated as Bond Registrar for the Series 2025 Bonds. The Bond Registrar is hereby also designated as Authenticating Agent for purposes of authenticating any Series 2025 Bonds issued hereunder or issued in exchange or in replacement for Series 2025 Bonds previously issued. The Series 2025 Bonds may be registered as transferred only on the bond register of the Bond Registrar with respect to the Series 2025 Bonds. No transfer of any Series 2025 Bond shall be effective for any purpose hereunder except upon presentation and surrender of such Series 2025 Bond at the office of the Bond Registrar with a written assignment signed by the registered owner of such Series 2025 Bond in person or by a duly authorized attorney in form and with guaranty of signature satisfactory to the Bond Registrar. The Authority, its agents, the Paying Agent and the Bond Registrar may deem and treat the registered owner of any Series 2025 Bond as the absolute owner of such Series 2025 Bond for the purpose of receiving payment of the principal thereof and the interest thereon and for all purposes hereunder, notwithstanding any notice, actual or constructive, to the contrary.

Upon surrender for registration of transfer of any Series 2025 Bond at the principal corporate trust office of the Bond Registrar, the Authority shall execute and the Authenticating Agent shall authenticate and deliver to the transferee or transferees a new Series 2025 Bond or Series 2025 Bonds of a like aggregate principal amount of authorized denominations and of like interest rate and maturity. Every Series 2025 Bond presented or surrendered for registration of transfer or exchange shall be duly endorsed, or be accompanied by a written instrument of transfer in form satisfactory to the Authority and the Bond Registrar duly executed by the Bondholder thereof or his attorney duly authorized in writing. The execution by the Authority of any Series 2025 Bond in denomination of \$5,000 or any integral multiple thereof shall constitute full and due authorization of such denomination and the Bond Registrar shall thereby be authorized to authenticate and deliver such Series 2025 Bond. No charge shall be made to any Bondholder for the privilege of registration of transfer or exchange, but any Bondholder requesting any such registration of transfer or exchange shall pay any tax or other governmental charge required to be paid with respect thereto.

The inclusion of the foregoing provisions shall constitute a continuing request from the

Authority to the Clerk of the Superior Court of Fulton County, Georgia, unless the signature of such Clerk shall appear by facsimile, to execute the certificate of validation on any replacement Series 2025 Bond issued.

Notwithstanding the foregoing in this Section, while the Series 2025 Bonds are held in Book-Entry Form, registration of transfers and exchanges shall be made in accordance with the Book-Entry System.

Section 2.7. Mutilated, Destroyed or Lost Bonds.